Truck Factoring: Everything You Need to Know

Get paid faster with Factoring.

Say goodbye to cash flow worries.

What is truck factoring?

Being a carrier can lead to a great deal of freedom, especially as an entrepreneur. But one downside of being an owner-operator is getting paid on time. If you’re lucky, you might get paid at the end of a delivery. But more often than not, you end up waiting for your money, depending on the shipper’s net payment requirements. You could wait 60 days (or more!) to see any cash for the cargo you hauled. Trucking factoring can help you avoid the headache of late and slow payments.

What is factoring in trucking, exactly? Sometimes known as transportation factoring, or even trucking invoice factoring, truck factoring gets you paid within days of a job instead of the usual 4-6 weeks. Factoring means you sell the invoices from your job to a third-party financial company, known as a factor. You walk away with the cash minus a factoring fee. The factoring company collects payment from the broker.

How truck factoring works

Entering into a factoring agreement is fairly straightforward. In fact, it isn’t too different from a normal pick-up and drop-off shipment, except you’ll send your paperwork somewhere else.

Successful truck factoring requires the following steps.

1. Find a high-paying load. Contact your broker or shipper for jobs that fit your needs and requirements. Or, check out the Truckstop Load Board for available jobs.

2. Deliver the freight shipment. Once you arrive and drop off the cargo, be sure to get the invoice, bill of lading, or any other documents from the shipper or broker.

3. Submit paperwork to a factoring company. Instead of hanging on to the invoice or freight bill and waiting for payment, you submit your forms to the trucking invoice factoring company. Also, instead of having to do the invoicing and billing yourself, some factoring companies (like Truckstop) offer full-service invoicing, taking that task off your plate. Also possibly required? Proof of operating authority and insurance. Check with the factoring company for specific details. In addition, check with your factoring company to see if it offers full-service invoicing. Truckstop does.

4. Get paid up to 98% of the invoice value. When you sell your outstanding invoices, a good truck factoring company will pay you within 24 hours, minus their fees. If you’re working with a broker, the factor will contact them for help in collecting payment from the shipper.

5. Your broker collects payment. The factoring company then collects money from the broker.

Truck factoring terms every carrier needs to know

While you’re thinking through the possibilities, here are some more terms you might run into if you’re pursuing payment through a factor arrangement. In the following glossary, the word ‘client’ is most often considered a carrier and the word ‘customer’ is most often considered a broker.

Advance rate. This is the cash the truck factoring company advances to you. It’s typically a percentage of the total invoice amount.

Client. This would be you, the carrier. You are the client of the trucking factory company that provided shipping services to the customer.

Customer. The customer is your shipper or broker, the one who issues you the invoice. The customer is also responsible for paying the invoice to the factor.

Reserve. The reserve rate is the percentage of your invoice that the truck factoring company keeps until the shipper pays.

Recourse. The factoring company will not absorb any credit losses that result from a customer defaulting on an invoice.

Non-recourse. The factoring company will absorb any credit losses that result from a customer defaulting on an invoice.

Full-service Billing. Full-service billing is a suite of services that outsources the management of your entire billing function. Truckstop invoices the broker, saving you the time and hassle.

Fuel Advance. Financing option that many factoring companies offer alongside their freight bill factoring programs. Fuel advances provide funding to cover fuel expenses at the time you pick up a load.

Broker Factorability (Factorable). The broker status that informs a carrier if they can factor a load with a specific broker. A broker is deemed “factorable” if they operate with a reasonably strong balance sheet and are financially sound.

Notice of Assignment. A notice that is sent to customers informing them that the invoice has been factored and pledged as collateral. The NOA also informs the customer of the new payment address.

UCC. A uniform act that harmonizes the law of sales and commercial transactions in the 50 states. UCC-1 is a legal notice filed by creditors to publicly declare their right to seize assets of debtors who default on loans.

Verification. The process where a factoring company verifies the validity and value of a client’s invoice with the customer.

Spot factoring. Spot factoring lets you choose which invoices to sell to the factor and when. You aren’t locked in to a specific contract. This also means you don’t have to factor all of your invoices, allowing you the flexibility to determine current and future payments.

Benefits of factoring trucking invoices

If you’re tired of the lag time between delivery and payment, then truck factoring could be for you. Factoring can deliver a lot of benefits for you and your business.

Faster cash flow

If you’re short on cash and need it to pay bills or expand your operations, trucking invoice factoring could be a great option. When you sell your invoices, you usually get paid much more quickly than the typical 30 to 60 days it might take for an accounts receivable department to process your check. In fact, once your application for truck factoring is processed, you could get paid for factored freight bills in as little as 24 hours.

Zero debts on the balance sheet

Another benefit of this process? It’s not a loan. This means you don’t accrue any debt on your balance sheet. Invoice factoring is also much simpler than traditional financing. Another plus: your credit score doesn’t matter. A factoring company might want to know your broker’s or shipper’s credit score. But your credit history is not important.

Reduced operational overhead

Freight factoring companies help free up your cash flow to pay bills, finance your operations, and take on new business. And, because factoring companies will often handle the back-office details of collecting your invoice, you don’t have to spend your time or money tracking down payments or bookkeeping. You can put that extra time back into your business or spend it your way, with friends, family, and hobbies.

Non-recourse payments

Again, non-recourse financing tends to charge higher fees than recourse factoring. But these higher factoring rates also protect your funding if your broker/shipper doesn’t pay the truck factoring company (as long as you filed the correct paperwork and terms on your end). Other advantages of non-recourse financing? You don’t have to deal with debt collections, it’s relatively easy to qualify for, and you can use it for short-term funding.

Get paid faster with Truckstop Factoring.

Truckstop Factoring pays you within 24 hours of the time you submit your invoices. Here are some other benefits:

- A low, flat fee. This means no hidden or down-the-road cost surprises when you sell your invoices.

- Non-resource factoring. This protects you in the event your shipper doesn’t pay. Truckstop also offers free broker credit checks.

- No minimum volume requirements. You can submit invoices for full truckloads, partial truckloads, or less than loads.

- Full-service billing. Truckstop invoices the broker directly, saving you time and hassle.

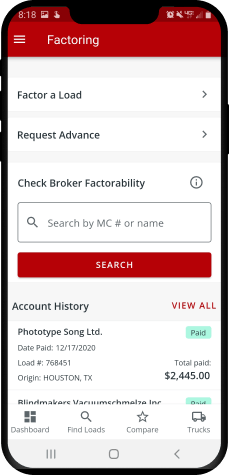

- Mobile app. Our user-friendly app is highly convenient, helping you manage your payments and cash flow on the go.

Start your Truckstop factoring application today!

Topics:

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.