Freight Factoring Programs: Which Type is Right for You?

Get paid faster with Factoring.

Say goodbye to cash flow worries.

Whether you’re an owner-operator or have a large fleet of trucks, you want to keep your trucks on the road, hauling freight and earning money. You also want to have a consistent cash flow so you can pay your bills, drivers, and expand your business.

Freight factoring keeps the cash flowing and reduces the administrative burden from financing loads, so you can focus on earning money and keeping your trucks full and moving.

What is a freight factoring program?

A freight factoring program pays carriers faster. Rather than sending invoices and waiting to get paid by the broker, you can get paid as soon as the same day from the factoring company.

You don’t have to worry about collections or waiting for a check when you sign up for a factoring program. Freight factoring can make a big difference in your cash flow. Without them, it takes 40 days on average to get paid, and some companies can take up to 90 days to pay their invoices.

Instead, factoring companies pay you, minus a service fee, and handle the collections for you.

How does a freight factoring program work?

A spot factoring program works primarily the same way you currently do business. You’re just sending the invoices somewhere different and getting paid more quickly.

Here are the five steps involved in truck factoring:

- Find a load. Pick up a profitable job from your shipper or broker. You can also find high-paying jobs on the Truckstop Load Board.

- Make a delivery. Haul the load and make your delivery.

- Submit paperwork to your factoring company. Gather your paperwork, such as freight bills and bills of lading, so you have everything you need to back up your invoice. Then, submit your forms online to the invoice factoring company. You’ll want to check with your factoring program to see if they need additional information, such as insurance or proof of operating authority.

- Get paid! It’s that simple. The freight factoring program “buys” the invoices from you and pays you, minus the service fee. The best factoring companies pay up to 98% of the value of the invoice and offer same-day payment options.

- Stop worrying about collections. The freight factoring company collects the money from the shipper or broker.

Which type of freight factoring program is best for your business?

Factoring programs come in several different varieties, and it’s important to know the difference. The most common type of factoring program is called recourse factoring. Other programs include non-recourse factoring and hybrid non-recourse factoring.

Recourse factoring programs

The factoring company will pay you and handle collections in a recourse factoring program. However, if your broker or shipper does not pay the invoice, you would be responsible for returning the amount you were paid, including any lost fees. When a broker or shipper doesn’t pay, you repurchase the invoice from the factoring company and take over collections yourself.

There are options, though. For example, instead of returning the money you received, you might be able to swap out the unpaid invoice with a fresh one of the same value. You might also be able to get a debit on any reserves being held.

Pros:

- Recourse factoring is slightly less expensive than non-recourse factoring. You get paid a bit more since there is less risk for the factoring program.

- You do not have to handle collections unless your broker or shipper does not pay the factoring company.

Cons:

- You take on the risk when shippers or brokers don’t pay.

- If the shipper or broker doesn’t pay their invoices, you have to repurchase them and chase collections yourself.

- If you have creditworthy customers that pay promptly, there’s less risk involved, and you can maximize your earnings with recourse factoring.

Non-recourse factoring programs

With non-resource programs, you have a little bit more protection in case invoices aren’t paid. For example, if a broker or shipper files for bankruptcy or closes during the factoring period, you might not be required to return what you collected. However, factoring companies also charge a slightly higher service fee for this added protection.

Pros:

- Factoring companies handle collections for you.

- If brokers or shippers do not pay for a qualifying reason during the factoring period, you do not have to buy back the invoice.

Cons:

- Non-recourse factoring pays slightly less for outstanding invoices due to the increased risk factoring companies take.

- In many cases, the only protection is bankruptcy during the factoring period.

- When evaluating factoring programs, it’s important to understand what is considered a qualified reason for non-payment by a customer. Some companies offer expanded definitions beyond bankruptcy, but they may also charge higher fees for the added protection.

Hybrid non-recourse factoring programs

Hybrid factoring programs let you choose whether to do recourse or non-recourse factoring on an invoice-by-invoice basis. It can be a good choice for carriers with a mix of stable, credit-worthy customers and some less reliable.

Pros:

- A hybrid factoring program lets you choose which invoices use recourse or non-recourse factoring.

- It can be easier to qualify for hybrid factoring programs than full non-recourse factoring.

Cons:

- Fees vary because you’re choosing different types of factoring programs.

What to consider when choosing a freight factoring program for your company

- Contract terms. Make sure you understand and are comfortable with the contract terms and commitment length.

- Invoice sizes. Depending on your qualifications, some factoring providers limit the total invoice amount they will buy from you.

- Factoring fees. Pay close attention to how much factoring companies charge by invoice type. Some apply different rates depending on how long invoices take to pay. For example, if a broker or shipper takes 60 or 90 days to pay the factoring company, the interest rates or factoring fees might be higher than if they were to pay within 30 days.

- Qualification requirements. Qualification is usually easy and quick but can influence any extra fees you might be charged. When you apply to a factoring company, they’ll look at your qualifications, including your credit score, bank statements, revenue, and how long you’ve been in business.

- Funding speed. How fast do you want to get paid for your invoices? Some companies offer same-day pay or fund via fuel cards.

- Recourse vs. non-recourse vs. hybrid options. As we discussed, consider which option is best for your business.

What is needed to apply for a freight factoring program?

To apply for a freight factoring program, you will need to fill out an application. Approval usually only takes a few days once all the information is collected and reviewed.

You will need to provide information including:

- Operating authority

- Proof of insurance

- Articles of incorporation

- A current customer list

Even if you have poor credit, no credit, or bad debt, you might still qualify for a freight factoring program. Factoring companies evaluate the creditworthiness of your brokers and shippers more than yours.

Get paid faster with Truckstop Factoring.

Truck factoring is a great way to get paid quickly and stop worrying whether someone will pay their bill on time. It provides a consistent cash flow without the hassle, so you can focus on booking and hauling high-paying loads rather than chasing collections. You get immediate cash flow with zero debt on your balance sheet.

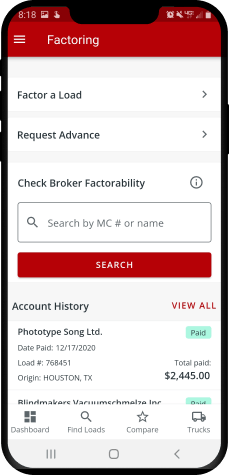

Truckstop Factoring has low flat fees, so there are no surprises. We offer free broker credit checks and non-recourse factoring.

There are no minimum volume requirements so you can factor as little or as much as you like. Truckstop Factoring invoices the broker directly and provides a free mobile app so you can manage your payments and cash flow from anywhere.

Start an application to begin factoring today.

Find out how our platform gives you the visibility you need to get more done.

Get helpful content delivered to your inbox.

Schedule a demo.

Find out how our platform gives you the visibility you need to get more done.