Recourse vs. Non-Recourse Factoring

Get paid faster with Factoring.

Say goodbye to cash flow worries.

Invoice factoring is the practice of “selling” your invoices, or accounts receivables, to a company that then pays you right away for that invoice, minus a fee. This helps you increase cash flow to pay bills, finance operations, take on new business, and handle business expenses as they come up. Factoring companies may also handle the back-office details of collecting your invoices, so you don’t have to track and chase down payments. This not only saves you money but also valuable time.

There are two types of factoring: recourse and non-recourse freight factoring. The major difference between the two, besides the cost, is what happens if brokers or shippers don’t pay your invoices promptly. Here are the details you need to know to make the right choice for your business.

Recourse factoring

Recourse factoring is the most common type of factoring. While you might have sold the invoice to a factoring company, you are still ultimately responsible for collecting the balance if the factoring service can’t.

The factoring company should make every reasonable attempt to collect for you. But if your broker or shipper refuses to pay on time, you have to buy that invoice back from the company and take over collection efforts yourself. You’ll pay a lower fee in exchange for assuming this risk yourself.

The advantages of recourse factoring

Here are a few reasons why you might want to consider recourse factoring:

- Less expensive than non-recourse factoring

- No collections work unless your broker or shipper doesn’t pay

- Easy to qualify for since you’re assuming the risk of bad debt

If you already have credit monitoring and qualification practices in place, recourse factoring might be a good solution for you.

The disadvantages of recourse factoring

Entering into a recourse factoring agreement does come with more risk:

- If the broker or shipper does not pay, you have to buy back that debt and collect it yourself.

- This buyback can have a huge impact on your cash flow.

- If you can’t buy back the invoice, you might end up in collections yourself.

There are ways to minimize the risks. Here’s what to think about when considering recourse-factored invoices.

Which businesses should use recourse factoring?

Your business may want to consider recourse factoring if:

- You work with credit-worthy brokers and shippers who pay on time and reliably.

- You want to pay lower fees and sell invoices at the lowest rates.

- You can easily repurchase invoices if the broker/shipper fails to pay.

In short, stable businesses with a good cash flow plan are best for recourse factoring.

Non-recourse factoring

Non-recourse factoring is when the factoring company takes on the ultimate responsibility for debt collection. Because the factoring company assumes the risk, you might only be able to get non-recourse factoring if the company knows and trusts your broker or shipper. In addition, you may only be protected against specific circumstances such as them going bankrupt.

The advantages of non-recourse factoring

Non-recourse factoring has two significant advantages over recourse factoring:

- Someone else does your collections for you, even on covered bad debt.

- You only have to buy back the invoice if the debt is uncollectible for a reason that isn’t covered.

Disadvantages of non-recourse factoring

You’ll also want to consider the drawbacks of non-recourse factoring:

- More expensive than recourse factoring

- Limited protection

- May only be available for specific companies

The primary disadvantage of non-recourse factoring is the cost. Generally, non-recourse factoring is more expensive than recourse factoring. The higher price serves to protect the factoring company from potential bad debt.

It is also essential to understand that the level of protection varies by company. The more protection, the higher the cost. If the debt is uncollectible for a reason not covered by the factoring agreement, you will need to buy it back.

What isn’t covered by a non-recourse factoring agreement?

Every factoring company is different. Some only cover the debt when the broker or shipper goes bankrupt or out of business. Others offer broader protection. But in general, these situations are rarely, if ever, covered:

- Invoices that you send directly instead of through the factoring company

- Invoice disputes

- Breach of contract

- Situations in which you contribute to the credit problem

Read the fine print carefully before signing any agreement.

Which businesses should use non-recourse factoring?

Companies that may want to take advantage of non-recourse factoring include:

- Businesses with high-risk vendors.

- Sole proprietors who don’t want to deal with accounts receivable and want protection against bad debt.

- New businesses that lack the resources to buy back invoices.

Remember to look carefully at each provider’s terms and options to find the right factoring choice for you.

Hybrid factoring model

A hybrid freight factoring model combines the best of both recourse and non-recourse factoring. You can decide invoice by invoice whether to choose recourse or non-recourse factoring. The cost falls somewhere in the middle, and you share some of the risks with the factoring company.

Hybrid factoring can be easier to qualify for than full non-recourse factoring. It can also be a good option if you have a mix of credit-worthy vendors and those who are less reliable. Depending on your factoring company, you may be able to use hybrid factoring even if you only factor some of your invoices.

Understand the factoring terms.

If you’re using non-recourse factoring, you’ll want to know exactly what is and is not covered. But no matter whether you choose recourse, non-recourse, or hybrid factoring, it’s extremely important to pay attention to the terms of your agreement.

In general, factoring companies will start contacting the debtor after 40 days of non-payment. You’ll typically need to buy back unpaid invoices at 90 days if they’re under a recourse agreement or are not covered by your non-recourse agreement. But you might have options, such as signing over a portion of future advances until the debt is paid. Look for a company with an excellent reputation willing to work with you.

Recourse vs. non-recourse factoring: Which is better?

In general, this is a question you will have to answer based on your trucking company and your circumstances. Each method has different costs, advantages, and disadvantages. Here are some questions to ask yourself before you decide:

- How creditworthy is this broker/shipper?

- Can I absorb the costs of factoring and still be profitable long-term? (If not, you may want to look at the rates you charge.)

- What kind of risk can my company handle?

- Does my factoring company handle slow payments? How soon will I have to buy back unpaid invoices?

- What circumstances does non-recourse factoring cover, and how likely are those to occur?

- Should I factor all of my invoices by recourse or non-recourse factoring, or should I take a hybrid approach?

Time and money are usually the major things to consider. Can you do something better with your time than billing and chasing down payments? Is it worth any fees you pay not to have to do those things? The type of factoring you choose may also change over time as you acquire new and reliable business relationships.

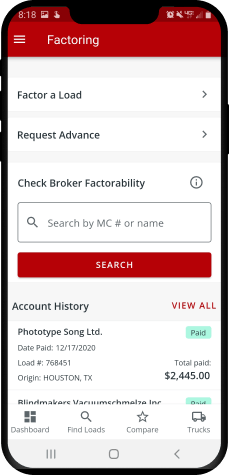

Find the right factoring company for your business.

How do you find the right factoring company for your particular operation? Get the facts and debunk the myths of factoring with Truckstop.

You’ll learn that:

- All factoring companies are not alike.

- You don’t have to factor every invoice.

- Our factoring does not lock you into any long-term contracts.

Truckstop offers factoring services that are simple and easy to use. We offer flat fees, non-recourse factoring, full-service billing, flexible cancellation, and no minimum volume requirements. You can even get paid within 24 hours.

You get paid on invoices when you need the money the most. Want to learn more about our factoring services and how they can work for your company? Request a demo today.

Topics:

Find out how our platform gives you the visibility you need to get more done.

Get helpful content delivered to your inbox.

Schedule a demo.

Find out how our platform gives you the visibility you need to get more done.