Freight Factoring: What Is It and How Does It Work?

Get paid faster with Factoring.

Say goodbye to cash flow worries.

Running a trucking business today is hard work. It’s not just about managing your truck and schedule. You also have to handle tasks like HR, marketing, and accounting—all on your own. Freight factoring helps with the accounting part by making it easier to manage your cash flow.

If you’re wondering how freight factoring actually works and if it is right for your trucking business, we have you covered. We outline all the details and how freight factoring can benefit your trucking company.

What is freight factoring?

The freight business basics are pretty simple: You pick up goods at one location, deliver them to the next, and issue an invoice to the shipper or broker, who pays you for your service. Your profit is the amount you get paid minus your costs for delivering the cargo.

But usually, you don’t get paid right away. The industry average is 40 days, and some companies may take up to 90 days to pay invoices. That’s a long time to wait, and it can disrupt your cash flow.

Freight factoring provides quick cash for your invoices by outsourcing the collections process to a third-party factoring company company. They purchase your invoices at a slightly reduced rate, eliminating the need for you to chase payments or use your savings while waiting for payments.

How does freight factoring work?

Freight factoring does one simple thing: It pays you faster for work you’ve already done.

- You haul a load from one place to the other.

- You submit your paperwork to the factoring company rather than the broker.

- You get paid right within 24 hours of the load being verified.

- Your broker pays the factoring company in 30-45 days.

Freight factoring vs. quick-pay

Some brokers offer quick-pay, an option that expedites payments in exchange for a fee. Typically, carriers can expect payments in 2-5 days if they choose a quick-pay option. A freight factoring company usually pays carriers within 24 hours of receiving an invoice and verifying the load.

What does a freight factoring company do?

A freight factoring company takes on some of your business’s accounts receivable functions. They often invoice brokers for you, and the broker pays them, not you. They charge modest factoring fees for this service.

Freight factoring companies will also perform broker credit checks for you. Because they collect from the brokers or companies on your behalf, freight factoring companies free you up to handle other aspects of running your business.

What are the benefits of freight invoice factoring?

Freight factoring has a few significant benefits. Most importantly, it helps a carrier’s financial stability and allows them to focus on core operations, such as expanding their fleet or improving service quality, without worrying about cash flow constraints.

Get paid within 24 hours.

Once your invoice is approved, you will receive a faster payment. Fast payments improve cash flow and operating capital for small trucking companies and large carriers.

Reduce the accounting burden.

You effectively outsource your accounts receivables department to another company for a minimal fee. This takes a large part of the accounting burden off your plate so you can focus on other tasks. You won’t have to spend valuable time making collection calls and chasing down invoices.

Qualify brokers.

Another benefit is that a factoring company will often qualify brokers for you, performing credit checks to ensure their reliability. If you don’t have the resources or time to do this, freight factoring can help be an additional layer of vetting.

Improve forecasting.

Freight invoice factoring guarantees you’ll be paid on time, which makes forecasting much easier. This service helps you create a business plan you can stick to, especially if your business is just getting off the ground.

How does a factoring company assess risk?

Factoring companies bear the risk of unpaid invoices and deal with the challenge of collecting from trucking companies if customers fail to pay.

Here are some things a factoring company looks at before partnering with you:

- What is your credit history? This is not as large an issue as some others, but it does play a role in a factoring company’s willingness to partner with you.

- Are your customers creditworthy? More important than your personal credit score is the stability of the customers you bill. Will they pay their invoices on time? A freight factoring company often requires that brokers or customers be approved before they will factor your invoices.

- Are the invoices valid? Especially with fraud plaguing the market, freight factoring companies want to verify that each invoice they process is genuine.

- Do you have a diverse customer base? Working with several brokers—as opposed to just a few—lowers the risk of non-payment.

- Is a lack of cash flow making it challenging to operate your business day-to-day?

- Do you have slow-paying customers affecting your ability to pay bills on time?

- Have you done credit checks to make sure a broker will pay before you take a load?

- Are you wasting valuable time on collections calls that you could spend on other things?

What’s the difference between recourse and non-recourse freight factoring?

Recourse is a clause in a freight factoring contract that allows freight factoring companies to collect from you if your customer does not pay promptly (or worse, doesn’t pay at all).

Non-recourse means that if your customer declares bankruptcy or goes out of business between the time you submit your invoice and when they are supposed to pay the factoring company, the factoring company will not try to collect from you. If a customer simply fails to pay, however, a non-recourse agreement won’t prevent a factoring company from pursuing payment from you.

Truckstop offers non-recourse factoring, with some additional benefits:

- We charge flat rate fees, so there are no surprises.

- You can cancel your freight factoring service anytime.

- There are no minimum volume requirements.

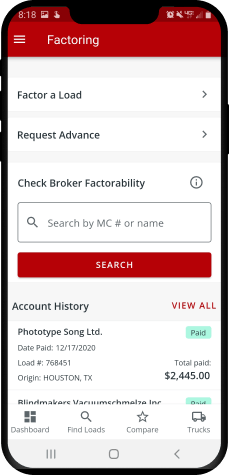

- You can submit and track your freight factoring invoice from nearly any device connected to the internet, throught the Truckstop Go app.

Other terms come into play besides recourse and non-recourse agreements in trucking factoring contracts. Once you become familiar with them, it will be easier to read and understand the legal terms.

Freight factoring terms, rates, and qualifications

Before signing an agreement with a factoring company, make sure you understand the fine print and what freight factoring will cost you.

Rates

Freight factoring rates vary based on your business volume. A factoring fee can range from 2.5%–5% per invoice. Some companies charge an initial setup fee for your first invoice.

The most important thing to remember about fees, even flat fees, is to subtract them when figuring out your profit and loss on each load.

Terms

You might see the term “spot factoring,” which means you can pick and choose which invoices you want a factoring company to manage. Many providers, including Truckstop, offer spot factoring options.

Spot factoring is usually better for smaller trucking companies. Larger freight companies often use contract factoring to negotiate their rates, but they must factor all of their invoices.

Qualifications

Not everyone qualifies for freight invoice factoring. You will have to meet some requirements before being approved:

- You’ll need to meet a minimum credit score determined by the factoring company.

- It will take some time to get approved for your first factor.

- You need to have been in business for at least 90 days.

- Newer trucking companies usually need to provide a minimum annual income or projected yearly income.

How to choose the right factoring company

When looking for a freight factoring company for your trucking business, pay particular attention to these items:

- Application process. You will need to provide some basic info — like your tax ID, MC authority number, and direct deposit details — to apply for factoring. Gather all essential information in advance so you can expedite your application.

- Speed of payment. How fast will get paid and under what circumstances? This is an important question to ask, if you want to improve your cash flow management.

- Stability. Look for a factoring company that is well-established, with a reputation for good customer service.

- Borrowing capacity. There will be a maximum credit line or factoring facility that caps how much money you can “borrow” against your outstanding invoices at any one time.

- Program types. Do they offer recourse, non-recourse, or a mix of the two?

- Advancement percentages. Depending on the agreement, you might get the entire payout amount or a portion, while the factoring company holds some in reserve.

- Fee transparency. In addition to a flat factoring fee per invoice, some companies may charge fees for ACH transfers, or add a surcharge if you don’t meet a certain threshold of invoices. Make sure you ask about all fees and what each fee covers.

- Contract termination. The factoring company will have a detailed contract for your review. To end the deal, you will have to give notice before the end date, and that notification window may vary based on the factoring company. You also want to make sure you understand what happens if you terminate an agreement when the factoring company still has invoices that your customers haven’t paid.

- Additional fees. A factoring company might charge additional fees, such as per-transaction costs, administrative or setup fees, or extra fees for faster pay. There may also be penalties for early termination.

Start factoring today.

Freight invoice factoring streamlines your payment collection to get you paid faster so your business keeps moving.

With Truckstop Factoring, you can say goodbye to cash flow worries. Get started today.

Find out how our platform gives you the visibility you need to get more done.

Get helpful content delivered to your inbox.

Schedule a demo.

Find out how our platform gives you the visibility you need to get more done.