Factoring Agreements: Everything Carriers Need to Know

Get paid faster with Factoring.

Say goodbye to cash flow worries.

Whether you’re an owner-operator or you’ve got a fleet of trailers on the road, managing your cash flow can be a challenge. It’s easy to get overwhelmed by paperwork, tracking invoices, and collecting what you’re owed. That’s why many carriers turn to invoice factoring to get paid faster.

What is a factoring agreement?

A factoring agreement is a legal contract that essentially sells your outstanding invoices to a factoring service. The factoring agreement details the terms, conditions, and costs for paying your invoices in advance. Basically, you’re getting a short-term loan using your invoices as collateral. The factoring business will charge a fee for this service, but they’ll also handle collections for you.

Fees to look for in a factoring agreement

The factoring fees are usually in the fine print, but it’s critical you understand them. Beyond the typical factoring fees associated with an advance against an invoice, you also need to pay close attention to origination fees and monthly fees.

Here are the most common factoring fees explained:

Origination fee

Factoring companies usually charge a flat fee at the beginning of any agreement. Costs can vary depending on the number of invoices you factor, the expected invoice amounts, and risk analysis.

Monthly fees

Some factoring services charge a minimum monthly fee for maintenance. These fees can be a flat fee, a percentage of invoices, or require minimum payments based on usage.

Termination fees

Depending on your factoring agreement, you might also have to pay an exit fee for ending an agreement early. Look for factoring agreements with either minimal or no termination fees.

Other factoring agreement terms and conditions

In any legal contract, the details are important. You’re committing to uphold the terms and conditions of a factoring agreement, so it’s helpful to understand the key items you will likely encounter.

Customer limit

This is the maximum funding you can get for outstanding invoices from any one of your customers at a given time.

Here’s an example. While you might have a $20,000 overall limit (credit line) available, your factoring agreement might limit you to collecting only $5,000 per invoice or customer at a time.

Factoring commissions

Factoring commissions are the fees you pay for factor invoicing — usually a percentage of each outstanding invoice.

Minimum sales commission

Look carefully for this clause in any factoring contract. Some companies set a minimum commission that you will be required to pay whether you use their services or not.

Reserves

Depending on the invoice factoring company you work with, you will likely get an advance against your invoice. The service will then charge fees and hold the outstanding amount, or reserves, in escrow until the broker or shipper pays the invoice. Depending on the agreement, reserves might be held for days or weeks.

For example, let’s say you’re a carrier with an invoice for $5,000. With a 90% advance rate, you would get $5,000 x 90% or $4,500 paid upfront. The invoice factoring service would hold onto the remaining $500 until the invoice is paid. Once payment in full is received, the service will release the remaining part of your payment minus their factoring rate (or commission).

Sale and purchase of receivables

The factoring agreement will detail how the sale and purchase of receivables will be handled. Many agreements require you to sell all of your accounts receivables (AKA invoices) to the factoring service. For more flexibility, look for an agreement that allows you to pick and choose which accounts you factor.

Invoicing and assignment schedules

When you use invoice factoring, you are selling your invoices to the factoring service. They are responsible for collecting payments from brokers and shippers. You’ll need to put a notice on any invoices that payments should be made to the factor. If a payment comes to you directly from a customer, you must turn it over to the factoring service.

You might also be required to send a list of the accounts and invoices you have assigned to the factoring service.

Payment of the purchase price of an account

In a typical factoring process, the factor pays your net invoice amount, deducting commissions or fees, credits, chargebacks, and any reserves. Some factoring companies will also pay you if a shipper or broker declares bankruptcy or becomes insolvent.

Advance amount

The advance is the amount you receive when you submit an invoice for factoring. It’s usually a pre-determined percentage of the purchase price. You’ll want to check if there are any limits on the dollar amount of advances you can have outstanding at any one time.

Obligations and interest

This section lists your obligations to the factor under the factoring agreement, including things like fees, service, wire transfers, or any other factor charges. It should also list any interest rates associated with fees and any rate changes due to default.

Stay on the road and in the money.

Say goodbye to cash flow worries. Truckstop Factoring keeps you in the green.

Representations and warranties

A factoring agreement should include a section about representations and warranties. It will likely have statements that you attest to, such as your company being solvent and not in violation of any laws. You also agree that the invoices you submit are legitimate and that you have the legal right to submit them clear of any security interests or liens.

If you fail to live up to these representations and warranties, the factoring company can deny payment or take legal action against you.

Termination provisions and events of default

Factoring agreements typically include an initial term and renewal terms. Most commonly, agreements have an initial term of one to three years with automatic annual renewals unless one party gives notice of termination.

It’s common for factoring services to reserve the right to terminate the agreement at any time with notice or upon default. The best factoring agreements let you operate on a month-to-month basis and terminate the agreement at any time with notice.

Security interests and remedies

If you receive advances against your invoice factoring, the factoring service will use your equipment or property as collateral in the amount they’ve paid you. It’s rare, but if you went into default, the factor could seize your property and sell it to recover their losses.

6 factoring agreement mistakes every trucking company should avoid.

Invoice factoring can be a great way to get cash quickly and let someone else worry about collections. While you lose a percentage of each invoice for the service, you’ll get paid more quickly and efficiently.

But do yourself a big favor and avoid these common mistakes many carriers make when entering into a factoring agreement.

- Not reading the fine print.

- Not knowing the requirements.

- Getting tied into a long-term contract.

- Sending purchase orders by mistake instead of invoices showing the job is done.

- Failing to consider spot factoring options.

- Overlooking non-recourse factoring options.

When considering your options, ask to see a sample factoring agreement. Don’t rely solely on what you’re told or see on a website. Review the factoring agreement sample carefully since it will be the governing document in case of any dispute.

Find the right factoring company for your business.

Truckstop makes factoring easy. After a load is complete, submit your paperwork, and you get paid within 24 hours (upon invoice verification) with no hidden fees. We’ll handle invoicing the broker for you. With a non-recourse factoring agreement, you still get paid if the broker can’t pay because of credit insolvency.

Unlike other companies offering factoring contracts, Truckstop gives you more flexibility. You’re not locked into any long-term contracts, and you can choose which invoices you want to factor. You don’t have to factor every load.

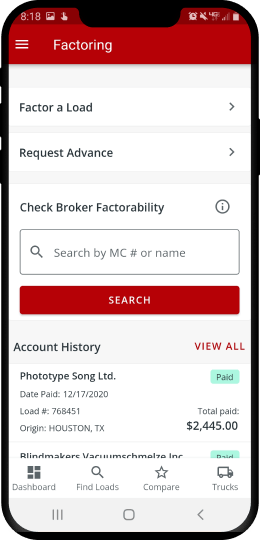

With our Factoring app, you can factor loads on the go, apply for advances, get instant credit checks on brokers, and view your paid (and unpaid) load history.

Want to learn more about the factoring process? Contact Truckstop for more details.

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.