How to Start a Trucking Company: A 14-Step Guide

Find your next load

Make more money starting now.

TL;DR

Starting a trucking company requires a solid business plan, a commercial driver’s license (CDL), and careful setup including choosing a business structure and obtaining an EIN. You’ll also need to buy or lease a truck, get insurance, open a business bank account, and apply for trucking authority and other essential licenses and permits.

Starting or buying a trucking company means enjoying freedom, flexibility, and, hopefully, profit. Before you get rolling, you need to know the ins and outs.

This guide breaks down how to start a trucking company. Whether you’re an entrepreneur or a seasoned trucker ready for a new challenge, this roadmap will drive you to success!

Why start a truck-driving business?

Truck drivers moved 11.18 billion tons of freight in the United States in 2023. This high-demand industry creates opportunities for savvy entrepreneurs. Starting a trucking company as an owner-operator or fleet owner has many perks:

- Freedom: You control how your business operates. You decide which clients to take on, what loads to haul, and your own schedule.

- Profitability: Owners’ gross salaries are around three times more than company drivers.

- Tax benefits: Business owners can deduct fuel, maintenance, and insurance expenses. Buying company equipment also comes with tax perks.

- Job satisfaction: Building a successful trucking company can give you a feeling of fulfillment.

Step 1: Create a business plan.

A business plan outlines your company’s objectives, operations, and financial forecasts and is essentially a roadmap for managing your business. A solid business plan can help you secure funding or investors.

According to the Small Business Association (SBA), a typical business plan includes:

- Executive summary: Summarize your company, its goals, and how you plan to achieve them.

- Company description: Describe your client base and what problems you will solve for them. Explain what sets you apart from other trucking companies. Include any trucking industry knowledge and experience that benefit your company.

- Market analysis: Research competitors and your target market to identify trends.

- Company structure: Establish your organizational and legal structure. Add details like your business type and who will do what.

- Services: List the services you will offer customers and the benefits of these services.

- Sales and marketing: Describe how you plan to attract customers. Then, explain what securing business will look like.

- Funding needs: Include a funding request only if you ask for financing.

- Financial projections: This roadmap explains how you will accomplish your revenue goals.

Knowing how to create a trucking business plan can set you up for success.

Step 2: Get your commercial driver’s license.

Truck drivers must have a valid commercial driver’s license (CDL), according to the Federal Motor Carrier Safety Administration (FMCSA). Those over 18 can apply, but you must be 21 or older to drive interstate. The application includes submitting documents (ID, residency, SSN), vision tests, and knowledge exams. After receiving a commercial learner’s permit (CLP), you perform a pre-trip inspection and road test. After passing these tests, drivers pay the applicable fees and receive their CDL.

Step 3: Set up your business.

Follow these steps to set up your trucking business.

Choose your business name.

Decide on a name that represents your mission or sets you apart. Check availability on the United States Patent and Trademark Office website. Then, register the business with your state.

Decide on a business type.

Choose among these different business structures:

- Sole proprietorship: This is an unincorporated business owned and operated by one person. Filing taxes is cheaper and easier with sole proprietorship However, you take on more personal liability.

- Partnership: Two or more people run and own a business.

- Limited liability company (LLC): Separating business and personal liabilities protects personal assets. All owners share tax responsibility but have no business debt liability.

- Corporation: You gain higher personal liability protection, but this structure is more complicated.

Consult a tax accountant to find the structure that best suits your needs and helps you navigate future tax filings.

Get an EIN.

An Employee Identification Number (EIN) identifies your company to the IRS for tax purposes. Visit the IRS website to apply for an EIN online.

Step 4: Buy or lease a truck.

Purchasing a truck has a high initial cost, but you will own the asset. If you prefer lower monthly fees, leasing is a better option. However, the truck won’t belong to you. Institutions offer varying financing terms depending on your credit history.

There are a few types of leases:

- Operators: Own or lease the vehicle full-time and always have it in your possession. You pay for permits, taxes, and maintenance. You have the option to turn in your truck when the lease ends.

- Lease-purchase program: Lease-purchase programs are for drivers with less-than-perfect credit. They can finance trucks right away but might pay more in interest.

- Terminal rental adjustment clause:You pay a down payment up fron At the lease end, you can pay the balance for the vehicle, or let the leasing company sell the vehicle and possibly share part of the profit with you.

Step 5: Get insurance.

Insurance protects against damages and losses. Do research to find the best rates, and refer to the FMCSA insurance filing requirements.

Here are some essential insurance policies you need for your trucking company:

- Liability insurance: This covers injuries or damage caused to others. The Department of Transportation (DOT) requires a minimum coverage of $750,000. Many brokers expect a minimum of $1 million in coverage.

- Cargo insurance: The loads you haul need damage, loss, and theft coverage. The minimum recommendation is $100,000 in coverage.

- Physical damage: Protect your truck in case of no-fault damage.

The Owner-Operator Independent Drivers Association (OOIDA) offers information and truck insurance for owner-operators.

Step 6: Open a business bank account.

A process agent accepts legal documents on your behalf in each state you operate in to fulfill FMCSA requirements. These agents ensure you receive notifications of any legal matters concerning your business.

Process agents are helpful because they work on your behalf if you ever have a problem in another state. Your process agent completes part of your trucking authority paperwork. You can find available process agents on the FMCSA’s website.

Step 7: Apply for your trucking authority.

A trucking or operating authority lets you operate legally as a truck-driving business. Obtain operating authority through the FMCSA by completing the OP1 and BOC-3 forms and paying the relevant fees. Any truck with over 10,000 gross vehicle weight (GVW) crossing state lines needs a USDOT number. Once approved, the FMCSA will send your authority certificate and a motor carrier (MC) number. The FMCSA is planning to phase out MC numbers, but you’ll still need a trucking authority.

Step 8: Get the relevant licenses and permits.

Besides your trucking authority, the FMCSA has other legal requirements for owner-operators:

- International Registration Plan (IRP): The IRP calculates distance-based licensing fees for trucks hauling cargo across state lines.

- International Fuel Tax Agreement (IFTA): After getting your IRP, you need an IFTA to simplify fuel tax

- Unified Carrier Registration (UCR): This permit validates your insurance coverage in the states you operate in.

- Standard Carrier Alpha Code™ (SCAC®): The National Motor Freight Traffic Association (NMFTA) issues codes to identify transportation companies.

- Electronic logging devices (ELDs): FMCSA-compliant ELDs monitor trucks for legal compliance, safety, and fair payment.

- Heavy Vehicle Use Tax (HVUT): You must pay this tax if your truck weighs more than 55,000 pounds. Apply using IRS tax form 2290.

Step 9: Monitor compliance.

You must meet applicable laws and regulations when you own a business. Compliance means filing quarterly tax returns, renewing CDLs, and monitoring industry regulations. Brokers favor carriers that are up to date with regulations to reduce liability. Staying ahead of changing regulations is vital to winning business as a truck driver.

The following regulations govern the trucking industry:

- Hours of service (HOS):The FMCSA sets HOS limits for truck drivers.

- Occupational Safety and Health Administration (OSHA): Standards for the health and safety of employed truck drivers exclude self-employed operator-owners.

- Inspection, repair, and maintenance records: The FMCSA requires motor carriers to log inspections, repairs, and maintenance.

Step 10: Open a business bank account.

A dedicated business bank account separates your personal and company finances. Separating accounts is essential for taxes and building a strong business credit score. Credit scores help secure any future loans and funding you might need to grow. The good news? You can start building credit right away. Use your business account to pay for essentials like licenses, permits, and insurance.

Step 11: Get start-up financing.

You may need to fund startup costs through loans or investors. Ensure you have completed all the steps above if you plan to go the funding route.

Check with banks and credit unions for financing. Credit unions are often easier to get a loan from, as larger banks want to see two years of operating history. You can also check online for trucking lenders.

Lenders, investors, or partners will want to see your business plan.

Step 12: Create a finance management system.

As you get your business moving, you need a steady cash flow. New trucks often cost between $100,000 and $200,000. Other expenses include equipment, supplies, labor, fuel, and utility payments. Then there’s insurance, legal fees, and maintenance costs.

Consider streamlining your accounting from the start. You can tackle bookkeeping yourself using software like Intuit QuickBooks or hire someone to handle it. If you choose to hire, wait until you have financing to hire the best bookkeeper you can afford. Hiring a skilled bookkeeper ensures your finances stay organized. Partnering with a tax attorney can provide invaluable guidance as your business grows.

You may want to consider factoring for quicker invoice payments. Factoring outsources billing and collections to a third party that purchases your invoices at a reduced rate. This method reduces the amount of administrative paperwork you do yourself, so you can focus on finding loads and making money. Factoring companies collect payments on your behalf and can prevent you from having to dip into your savings.

Step 13: Hire staff.

If you plan to run your company as more than an owner-operator venture, you must hire employees to support your company. Depending on your size and revenue goals, you might need to consider adding staff such as:

- Drivers

- Dispatchers

- Logistics coordinators

- Accounting or payroll managers

- Sales and marketing personnel

- Receptionists or administrative staff

Some trucking companies outsource these roles or wait until the volume of work requires an in-house team.

Step 14: Subscribe to a load board to get loads.

Subscribing to a load board is the best way to keep your trucks full and on the road. These online freight-matching platforms help connect you with shippers, brokers, and loads.

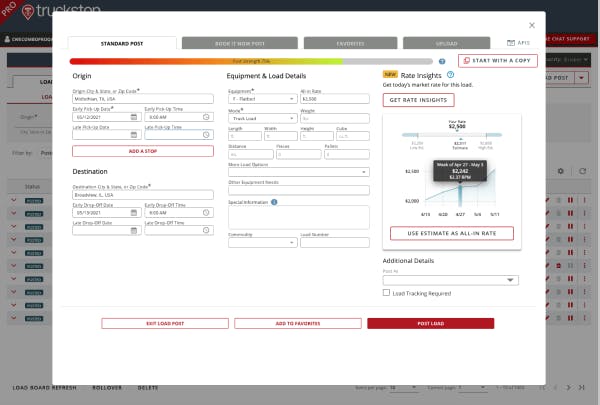

The Truckstop Load Board includes the following features.

Load searching

Load searching lets you perform unlimited searches in every state where you work. Access rates, load weights, and distances all with one tool.

Unlimited Lane and Truck Postings

View accurate routing and mileage data anywhere you drive. Know the distance to your next pickup and calculate fuel consumption. You can also view postings by load, truck, or lane. Use custom features for weight, height, quantity, and vehicle type.

Decision-making tools

Use Rate Insights and Decision Tools to help you negotiate better with brokers. Find out how many other truckers are viewing jobs, lane rates, and backhaul options.

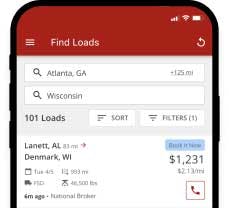

Instant load booking

Instantly book loads using any device, including your phone, tablet, or laptop. Use the refresh feature to update recent job postings in real time. Sort by the age of the listing or other categories. You can view the available rates and all load information up front before you book it.

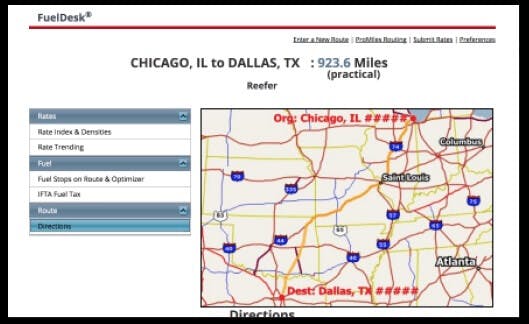

Fuel cost calculating

View the IFTA data and all available rates and routes. Quickly calculate fuel costs and find nearby fuel stops. Find alternate routes and rate criteria in a few simple clicks.

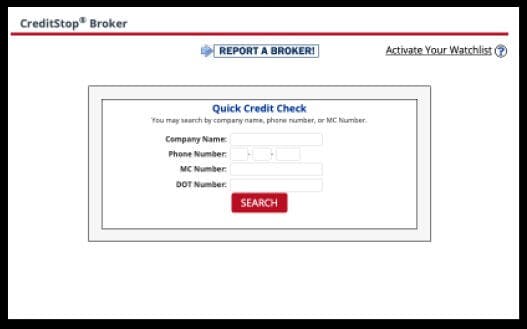

Credit Stop Broker

Run credit checks on a broker before accepting offers. Find reviews by searching for their company name or DOT number. Set up convenient watchlists to match brokers with drivers.

Flexible Payment Plans

Starting with a few drivers? Want to find the best rates fast? Choose from convenient plans that help you grow your business over time. Upgrade features as your company grows or you expand your services.

Ready to get started?

Owning a trucking business can be a great way to make a living. High carrier demand and truck shortages create opportunities to make more money. Remember, getting a new business off the ground takes time. The initial paperwork and credit requirements may seem overwhelming, but the reward can pay off!

Drive your way to success.

Truckstop has been connecting carriers, brokers, and shippers in the freight transportation industry for 30 years, providing innovative solutions to empower trucking businesses.

At Truckstop, we understand trucking gives you the freedom to make a living on your terms. That’s why we create innovative solutions to empower carriers. Use the Truckstop Load Board to find loads, control your schedule, and make money.

Explore The Truckstop Load BoardFAQs

Topics:

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.