Then and Now: 30 Years of Freight

Experience

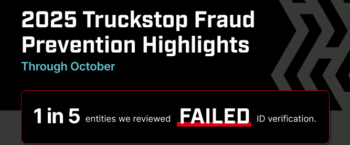

Unmatched Security

Help protect your business with the load board you can rely on.

Celebrating Truckstop’s 30th Anniversary

In 1995, Truckstop was born from a simple yet powerful idea: give independent carriers a better way to find loads. Thirty years later, that mission still drives everything we do. The freight industry has undergone a dramatic transformation over the past three decades, from relying on paper maps, fax machines, and payphones to utilizing AI-driven platforms and real-time load boards. This report reflects on those changes and the journey we’ve taken together, marked by resilience, innovation, and a relentless commitment to progress.

Here, we explore what the freight and logistics landscape looked like in 1995 versus today. We examine how industry size, regulations, technology, and expectations have evolved, and how Truckstop has led the way in making freight more efficient, transparent, and secure.

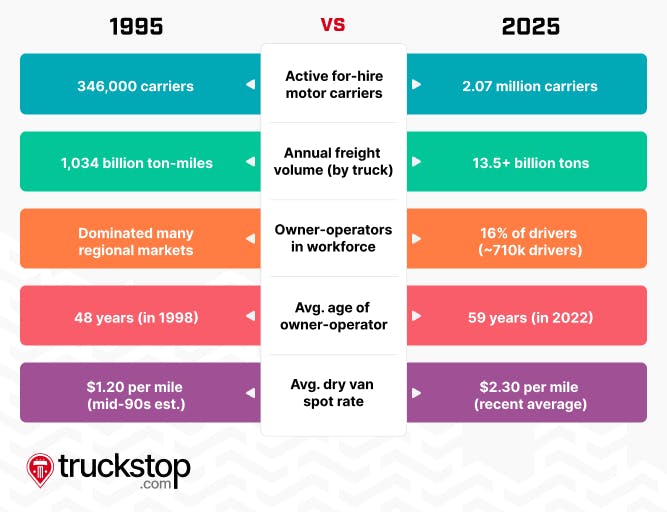

Industry Stats and Size (1995 vs 2025)

In 1995, the U.S. trucking industry operated on a much smaller scale than today. Approximately 346,000 interstate motor carriers were active. Those carriers moved freight totaling 1,034 billion tons annually. Carrier networks were often regional, focusing on specific corridors or states. The spot market for loads was relatively modest; dry van spot rates hovered around $1.20 per mile (mid-1990s estimate based on historical industry averages; no centralized rate tracking was publicly available at the time.).

Owner-operators were the backbone of rural and mid-sized freight markets. Many of these owner-ops managed their business with grit, paper load boards, and phone calls. They were around 48 years old in the late 1990s, reflecting a mature workforce with decades of experience.

Fast forward to 2025, and the scale of the industry has grown exponentially. There are now over 2 million registered for-hire motor carriers in the U.S. – nearly six times the number in 1995. Together, trucks move more than 13.5 billion tons of freight annually, a staggering volume that accounts for roughly two-thirds of all domestic freight by weight. The spot market has likewise expanded nationwide. Dry van spot rates have more than doubled from 30 years ago, averaging around $2.30 (or more) per mile in recent years (fluctuating with market conditions).

Broker networks now offer true national reach, connecting shippers and carriers across all regions with dense capacity coverage. A new generation of tech-enabled startup fleets has also entered the fray, further reshaping how freight is booked and hauled. Owner-operators today make up about 16% of the trucking workforce, representing roughly 710,000 drivers. The demographic has aged as well – the average owner-operator is about 59 years old as of 2022, nearly 11 years older than in 1998.

Figure: Growth in registered U.S. motor carriers from 1995 to 2025.

This explosive growth in capacity and freight demand underscores why modern tools and transparency are so important. What once was a more localized, paper-driven trucking market is now a massive, digitally connected national network.

Regulatory Environment: Then vs. Now

Then (Mid-1990s): The mid-90s were a time of deregulation and transition in trucking. The ICC Termination Act of 1995 effectively completed the deregulation of motor freight, abolishing the Interstate Commerce Commission in 1996 and lifting most remaining federal controls on trucking rates and routes. In this era, compliance and safety oversight were still largely analog. Drivers logged hours with paper logbooks, and compliance audits were conducted in person or via mailed records. Verifying a carrier’s authority or safety record often meant phone calls and faxes.

New safety programs were just beginning to take shape, like the Commercial Vehicle Safety Alliance (CVSA), expanding standardized roadside inspection and out-of-service criteria. In 1997, the SAFESTAT system was introduced to score carriers on safety performance. By the late 90s, SAFESTAT data (a precursor to today’s CSA scores) started influencing how regulators prioritized carriers for review, laying the groundwork for the Compliance, Safety, Accountability program in the next decade. Overall, while regulations existed (hours-of-service rules, weight limits, etc.), the enforcement was more manual, and the regulatory landscape was adjusting to a post-ICC deregulated world.

Now (Mid-2020s): The regulatory environment in 2025 is defined by digital oversight and higher standards for safety and integrity. A major change was the Electronic Logging Device (ELD) mandate, which took effect in December 2017 and required most drivers to switch from paper logs to electronic logging for hours of service. This has automated and standardized compliance with HOS rules.

In January 2020, the FMCSA’s Drug & Alcohol Clearinghouse became operational, creating a real-time database to flag drivers who have violated drug/alcohol rules. This Clearinghouse helps keep unsafe drivers off the road by ensuring carriers and enforcement officials can see past violations before a driver is hired. Another ongoing change is the move toward a Unified Registration System (URS). FMCSA plans to phase out the old MC (motor carrier) numbers by October 2025, consolidating carrier identification under USDOT numbers only. This streamlining is aimed at reducing fraud (preventing “reincarnated” carriers from hiding history by getting a new MC number) and simplifying the registration process.

In general, fraud prevention and transparency have become top priorities. Regulators and industry stakeholders have imposed stricter requirements for insurance, safety audits, and identity verification of carriers and brokers. The industry today faces heightened expectations for safety and compliance, with tools like electronic records, centralized databases, and instant online verification replacing the old trust-but-verify methods of the 90s.

Economic Conditions and Fuel Prices

Economic conditions for trucking have shifted significantly. Fuel costs tell a big part of the story. In 1995, diesel fuel averaged around $1.10-$1.15 per gallon in the U.S. By 2025, diesel prices have soared to roughly $3.80-$4.20 per gallon on average (varying by region and time of year). This nearly fourfold increase in fuel cost (even before adjusting for inflation) puts much higher cost pressure on carriers.

The total operating cost per mile for carriers has likewise risen. In the mid-2010s, the all-in cost to run a truck (including fuel, maintenance, truck payments, insurance, etc.) was roughly $1.70 per mile. Today, estimates put operating costs around $2.27 or more per mile on average for long-haul fleets. This increase is driven by fuel prices, but also by higher driver wages, insurance premiums, equipment costs, and regulatory compliance expenses. For example, modern trucks are more expensive and complex (with emissions technology, advanced safety systems, etc.), and insurance rates have climbed.

Despite these higher costs, competition in the trucking market (spurred by deregulation and new entrants) often keeps freight rates in check, squeezing margins. This makes operational efficiency more critical than ever. The ability to find good-paying loads quickly, minimize empty miles, and reduce waste (e.g. avoiding unnecessary deadhead or detention) can make the difference in profitability. It’s one reason why load boards and technology have been so readily adopted – carriers need every edge to offset the greater cost of doing business.

Trucking in 2025 operates on much tighter margins under higher expenses than in 1995. Fuel is the second-highest expense of operating costs, and every mile and gallon must count. The economic ups and downs (recessions, freight booms, pandemics) also tend to swing spot rates dramatically today, whereas in the 90s, rates were steadier but lower. This volatility makes good market data and forecasting important for modern carriers and brokers.

Technology: Freight Matching and Workflow

Perhaps the most striking changes in 30 years are in technology and daily workflows. The process of finding freight, booking loads, communicating, and managing trucks has been revolutionized since 1995.

Load Boards and Freight Matching

Then (1995): Load matching was a slow, often manual process. Many carriers found loads through bulletin boards at truck stops, checking physical postings or binders of available freight. Some subscribed to faxed lists of loads or used phone dispatch services. The early load boards were rudimentary; sensing the need for a more efficient and transparent solution, Truckstop (then called Internet Truckstop) launched one of the first online load boards, accessible via dial-up internet. Though early versions were simple, with just a handful of listings, they marked the beginning of a major shift, introducing digital access and laying the foundation for the tech-driven freight ecosystem we know today.

Now (2025): Today, freight matching is real-time and data-driven. Online load boards (like Truckstop’s platform) are rich, interactive marketplaces accessible from any smartphone. Millions of loads are posted electronically with details on rates, origin, destination, and requirements. AI-powered search and filtering helps carriers pinpoint the loads that fit their equipment and lanes. Historical rate data and market heat maps are available at a click, giving carriers insight into what a lane typically pays.

Features like “Book It Now” instant booking allow carriers to secure a load with one tap, no phone call needed, when a broker has set a pre-approved rate. In fact, Truckstop’s Book It Now feature (introduced in 2019) lets brokers post instant rates and preferred carriers can immediately claim the load, which can save 2-3 hours of back-and-forth per load for both parties. Overall, load boards have evolved from simple listing services into AI-enhanced marketplaces with rate analytics, credit scores, and identity verification built-in. A carrier in 2025 can find and book a load from New York to Los Angeles while sitting in the cab in a matter of minutes, a process that took infinitely longer in 1995.

Booking and Communication

Then: Once upon a time, “booking a load” meant phone calls and fax machines. A driver on the road in 1995 often had to find a payphone at a truck stop to call brokers or dispatchers. Loads were covered through verbal agreements and exchanged paperwork. Communication with dispatch was via pager or calling in from the road. If plans changed or a truck was delayed, the driver had to find a phone or use a two-way CB radio to relay the message. The process was not only slow, but also error-prone – misunderstandings and missed calls could easily occur. Dispatch offices kept whiteboards or spreadsheets of truck locations and statuses. In short, communication was in-person or voice-only, and often delayed.

Now: Digital communication has become the norm. Carriers and brokers today use mobile apps, text messages, and in-app chat to coordinate in real time. As soon as a driver books a load on a platform, they receive an electronic confirmation and often a rate confirmation PDF via email. Status updates that used to require a call (“I’m empty at the receiver” or “loaded and rolling”) are now frequently handled through app updates or automated geofence pings from the truck’s ELD unit.

Many modern Transportation Management Systems (TMS) integrate directly with load boards and messaging tools, so brokers can send a rate confirmation and the carrier can respond without ever picking up the phone. Real-time load alerts can notify carriers of new loads matching their preferences, and brokers can blast out offers to fleets instantly. The result is a much faster pace – what used to take an afternoon of calls might now be done in a few clicks and swipes on a smartphone. The communication is also documented and transparent, reducing disputes. While some personal touch remains (relationships are still key!), the day-to-day coordination is far more efficient and responsive than the era of payphones and faxed rate sheets.

Equipment and Telematics

Then: In the 1990s, trucks and infrastructure were the equivalent of “dial-up”. Drivers navigated with paper road atlases and directions given over the phone. In-cab technology might have been limited to a CB radio and maybe an early Qualcomm satellite unit for fleet owners, but independent owner-operators often just ran with a radio and their instincts. Maintenance was tracked in notebooks, and if a check engine light came on, you found a shop by memory or paper directory. Tracking a shipment meant calling the driver’s pager and waiting for a callback. Essentially, telematics were non-existent or in their infancy, and drivers relied on experience and analog tools to do their job. If a shipper wanted to know where a load was, the answer might be, “We’ll find out when the driver finds a phone.”

Now: Modern trucks are rolling high-tech platforms. Virtually all rigs are equipped with GPS fleet tracking devices or ELDs that report their location in real time. Dispatchers (and increasingly shippers) have portals where they can see a truck’s last known location and its estimated time of arrival. Route optimization software can suggest the best path, avoiding traffic or low bridges, and even optimize fuel stops. Engines now have advanced electronic control modules (ECMs) that constantly monitor performance; maintenance can be proactive thanks to remote diagnostics that alert fleet managers to issues before a breakdown happens.

Communication with drivers is often through in-cab tablets or smartphones that are integrated with dispatch systems. Many trucks are equipped with driver-assist technologies – from adaptive cruise control to collision avoidance sensors – improving safety. Even trailers are getting smarter (with GPS and cargo sensors for tracking).

The result is that visibility and efficiency have greatly improved. A carrier in 2025 can provide a shipper end-to-end tracking and accurate ETAs with ease, whereas in 1995, that level of visibility was unheard of. Additionally, telematics data helps reduce fuel consumption (through optimized driving behavior and maintenance alerts) and minimize downtime, all of which is crucial given the higher costs mentioned earlier.

Fraud Prevention and Security

Then: In the mid-90s, trust in freight transactions was built largely on reputation and relationships. A broker gave loads to carriers they or their colleagues had worked with before, or you checked references by calling around. Double-brokering or cargo theft scams were relatively rare, and when fraud did occur, it often relied on exploiting gaps in communication (e.g., an impersonator could fax stolen carrier authority papers because verification was manual). Identity verification was essentially done by feel – a carrier’s word and maybe their MC number and a faxed insurance certificate. Truck stops and industry grapevines served as informal sources of truth (“Have you heard of this company?”). While this system worked in a smaller, relationship-driven market, it was vulnerable to deception and had few safeguards beyond individual due diligence and trust.

Now: The freight industry has been forced to confront a wave of more sophisticated fraud, and in response, it has developed high-tech, systematic defenses. One major development is the use of identity verification services during carrier onboarding. For example, Truckstop’s RMIS (Registry Monitoring Insurance Services) platform now requires carriers to undergo digital ID verification, comparing a government-issued ID with a real-time selfie, when signing up with brokers. This helps ensure that the person registering a carrier is legitimate and ties a real identity to the account.

Two-factor authentication (2FA) or multi-factor login is also now common on load boards and broker platforms, preventing bad actors from hijacking accounts. Robust carrier onboarding checks are standard: RMIS and similar systems automatically pull a carrier’s authority status, safety rating, insurance info, and even check for common fraud red flags (such as recent changes in company address or phone). Machine-learning risk detection models scan load board activity for suspicious patterns, for example, if a brand-new carrier account suddenly tries to book high-value loads, it might get flagged for review.

Brokers today increasingly rely on tools like Truckstop’s Risk Factors, which provide comprehensive carrier vetting insights, going beyond basic safety scores to flag potential fraud risks, suspicious patterns, and compliance concerns. In 2025, trust is built as much through data and technology as through personal relationships. The industry broadly understands that fraud prevention is a shared responsibility, and both load board providers and brokers have implemented advanced tools and controls to guard against identity theft, double brokering, cargo theft rings, and other digital-era scams. The result is a freight network that, while not immune to fraud, is significantly more secure and transparent than the handshake-driven systems of the past.

The Evolution of the Driver and Broker Experience

Both carriers and brokers have seen monumental changes in their day-to-day experience. What it meant to be a truck driver or a freight broker in 1995 is almost unrecognizable compared to the roles in 2025.

Carrier Perspective (Then vs Now)

For truck drivers and small carriers, the job has been transformed by technology and market structure. In 1995, an independent owner-operator lived by the phone and the highway. After delivering a load, finding the next load might involve hours of calling brokers from a truck stop payphone or waiting for your dispatcher to fax you options. Information was scarce, you often took a load without knowing if the rate was fair, and you relied on gut feel and negotiation skills developed over years of experience. Getting paid was another adventure: paper invoices and waiting 30+ days for a check in the mail was standard, unless you used expensive factoring or quick-pay services. Many drivers managed their business with a notebook ledger, and tracking fuel expenses or mileage was manual. Despite the challenges, the 90s owner-operators valued their independence and the open road, even if it meant a lot of unpaid time chasing freight and paperwork.

By 2025, a driver’s experience is heavily tech-enabled, which brings new challenges but also new advantages. Today’s carriers (even one-truck owner/operators) can find, book, and factor a load all on a smartphone from the cab of the truck. Load board mobile apps deliver personalized load recommendations, and with features like rate tools and instant booking, drivers can be selective and quick. This level of insight and control helps small carriers compete with larger fleets on more equal footing. Real-time payment and factoring integrations mean drivers know exactly when they’ll get paid and can even receive advances immediately after delivery through digital factoring services.

The downside is that drivers now must manage a flood of digital information, multiple apps for different brokers, ELDs to monitor, messages pinging constantly, which can be overwhelming. Additionally, regulatory and safety oversight (ELDs, cameras, etc.) can feel intrusive to some traditional drivers. Still, many owner-operators will say they wouldn’t go back: modern tools have reduced a lot of the inefficiency and guesswork. A trip that once involved wrestling with maps, payphones, and surprise costs now benefits from turn-by-turn GPS, readily available load options, and quick pay. In essence, the freedom and control that drivers have always sought has, in many ways, increased – they have more transparency on loads and more power to run their business intelligently. The flip side is the market moves faster and can be less predictable (spot rates rise and fall quickly), so a savvy driver in 2025 has to remain informed and use the tech to their advantage.

Broker Perspective (Then vs Now)

The life of a freight broker has likewise evolved. In the mid-90s, a broker’s primary tools were the telephone, fax machine, and Rolodex of contacts. Much of a broker’s day was spent on a wired telephone, hustling to cover loads by calling carriers one by one. Load details were written down or perhaps managed in rudimentary software or spreadsheets. If you had a new load in Dallas, you flipped through your files for carriers you knew that ran Dallas lanes. Onboarding a new carrier meant faxing them a setup packet, getting their insurance and authority documents, maybe calling their references – a process that could take days.

It was a relationship-driven business: brokers developed close ties with a core group of carriers they trusted, because giving a load to a random unknown carrier carried significant risk (and finding new carriers was labor-intensive). Double-brokering or fraud was a concern, but on a smaller scale. Most deception a broker encountered might be a carrier running slightly overweight or fibbing about location, rather than identity theft. The broker’s role was very hands-on in tracking shipments, too – lots of phone calls to drivers for updates, then relaying that info to shippers.

In 2025, the modern broker operates in a highly automated and data-rich environment. Brokerages use Transportation Management Systems (TMS), like Truckstop’s ITS Dispatch, that integrate with load boards, compliance databases, and visibility tools. When a broker receives a new shipment, instead of flipping through Rolodex cards, they can post it on a load board and get instantaneous interest from carriers across the country. Many brokers now leverage automated carrier onboarding platforms like RMIS, which allow a carrier to self-onboard by uploading insurance and credentials, with the system automatically validating authority and safety ratings. This means a process that took days in 1995 can take minutes in 2025.

Brokers also have access to rich carrier performance data – safety scores, on-time delivery stats, even peer reviews in some systems, which helps in selecting reliable capacity. The workflow of covering a load has been partially automated. For routine loads, especially on digital platforms, a broker might have “Book It Now” enabled and wake up to find a load was covered overnight by a carrier clicking a button. Of course, brokers still actively negotiate and manage exceptions, but the volume one person can handle has increased thanks to tech. A single broker today might manage many more loads per day than their 1995 counterpart, with the help of software that automates load tracking (through truck GPS pings) and status updates.

Fraud prevention is now a significant part of the broker’s role as well, checking that the carrier offering to haul the load is legit, watching out for double-brokered loads, etc., using the new tools already mentioned. Overall, brokers have become logistics problem-solvers and data analysts as much as deal-makers. They leverage technology to cover freight faster and provide better visibility to shippers, but they also have to be more vigilant about cybersecurity and fraud. The essence of brokering – connecting shippers with capacity and ensuring service – remains, but how it’s done is night-and-day different from 30 years ago.

Shipper Expectations

Shippers have also upped the ante in what they demand from carriers and brokers. In the mid-90s, shippers primarily cared about two things: that their goods were delivered on time and at a good price. If those boxes were checked, they were generally satisfied. They didn’t expect to know where a truck was at any given moment; a delivery confirmation upon arrival often sufficed. Communication with shippers was via phone, and maybe weekly faxed reports for large contracts. Supply chains were a bit more forgiving with lead times, and “just-in-time” manufacturing was only beginning to ramp up.

Today, shipper expectations are far more complex and rigorous. In addition to on-time delivery and competitive rates, shippers now often require: end-to-end visibility, real-time tracking updates, electronic proof of delivery, and data insights. Thanks to Amazon-era customer expectations, many shippers want to track their freight like a package. They expect brokers or carriers to provide live tracking links or updates at regular intervals. Digital portals are common, where shippers can log in and see their shipments’ statuses.

Furthermore, shippers increasingly prioritize service quality metrics – they monitor tender acceptance rates, on-time pickup/delivery percentages, claims ratios for damage, etc., and they score their carrier and broker partners on these KPIs. There is also a growing emphasis on sustainability and compliance. Larger shippers ask about a carrier’s environmental initiatives (e.g. use of newer trucks for better emissions, or programs to reduce empty miles) and may favor carriers that align with their corporate sustainability goals. Cargo security and fraud prevention have trickled down to shipper concern as well – shippers want to know that the carrier picking up their load is the actual carrier and not an imposter, so they appreciate brokers who vet carriers carefully (some shippers now insist on using only brokers who have strict fraud prevention processes).

Overall, shippers in 2025 demand a higher level of professionalism, transparency, and reliability. They are less tolerant of failures and lack of information. This has forced brokers and carriers to raise their game and invest in tracking technology, provide better customer service, and differentiate on factors beyond price. Shippers have become more like strategic partners with their logistics providers, expecting innovation and continuous improvement, whereas in 1995 the relationship was often purely transactional.

Truckstop: Then and Now

1995: The Beginning

Truckstop (originally Internet Truckstop) was founded in 1995 to solve a widespread problem at the time: independent truckers were wasting too much time and money hunting for their next load. The very first version of our load board was primitive by today’s standards – it was a dial-up bulletin board system accessible via the early internet. It listed a small number of loads, mostly regional, and had no fancy bells or whistles. But, it was revolutionary in that it empowered drivers with information they previously could only get through brokers or truck stop postings.

If you were an owner-operator in the late 90s with a computer and a dial-up modem, suddenly you could see a few load opportunities on a screen, in near real time, without having to make a dozen calls. Our mission was to bring transparency and access to those drivers who wanted more control and freedom in their work. Even in that basic form, the Truckstop load board began to build a new kind of freight network – one built on openness, where the little guy could find opportunity without being in the “inside circle.” The ethos established from the start was one of leveling the playing field for carriers.

2025: Still Leading

Today, Truckstop is proud to be one of the most trusted names in freight technology, carrying forward that original mission into the digital age. Our platform in 2025 is a full suite of tools that serves carriers, brokers, and shippers alike throughout the freight lifecycle. We still run one of the largest load marketplaces, a place with hundreds of thousands of daily listings where carriers of all sizes find quality loads. But beyond the load board, we’ve introduced features to meet modern needs: from real-time rate analytics and negotiation tools, to compliance and onboarding services, to payment solutions and fraud prevention.

For example, our Authority Age filter allows users to screen carriers by how long they’ve been in business (helpful to identify new entrants versus. experienced ones), and our “Risk Factors” indicators help flag potential fraud or double brokering risks in a transaction. The Book It Now feature is an example of innovation designed with the carrier in mind. It simplifies the booking process so carriers can secure loads with trusted brokers in seconds. We have essentially woven trust and efficiency into the fabric of the platform. Even as the market has changed, our commitment remains to build tools that put the carrier first because we know if carriers are successful, the whole industry thrives.

Our evolution over 30 years, from a dial-up load board to an AI-driven logistics platform, mirrors the evolution of the industry. But at each step, we aimed to lead with solutions that set new standards. It’s no coincidence that many practices now common in freight (like digital onboarding, instant booking, identity verification) were areas Truckstop invested in early. We continue to innovate, guided by the core belief that when you empower the people on the road, you strengthen the entire supply chain.

Industry Impact

Over the decades, Truckstop has played a central role in shaping how freight is sourced, booked, and managed in North America. By introducing transparency into load availability and rates, we helped democratize access to freight, enabling small carriers and owner-operators to find loads outside of traditional broker networks, which in turn increased competition and efficiency in the market. We have been a vocal advocate for elevating industry standards, especially around issues like fraud prevention and payment integrity. For instance, Truckstop was among the first to implement robust carrier vetting and partner with law enforcement on cargo fraud issues, raising awareness across the industry about the importance of due diligence. We also contributed to modernizing compliance by integrating services like RMIS and enabling digital credential sharing, making it easier for carriers to maintain compliance and for brokers to verify it.

Truckstop’s platform and tools have allowed small businesses to compete at scale. A single-truck owner-operator using Truckstop can access freight opportunities nationwide, get instant market rate benchmarks, factor their invoice immediately, and ensure they’re dealing with a reputable broker, capabilities that were once available only to large fleets with extensive staff. By building these tools, we like to think Truckstop has been a partner in the success of countless carriers and brokers. Many of our customers grew from one-truck operations into sizable fleets, and they often tell us that having Truckstop “in their corner” made a difference, especially in the early days of their growth.

Moreover, Truckstop has fostered a sense of community and partnership in the industry. Through our user community, training resources, and events, we’ve always tried to facilitate knowledge-sharing, whether it’s tips on getting your authority, best practices for safety, or strategies to navigate a tough spot market. The trust and credibility we’ve built over 30 years is something we’re deeply proud of. As an industry pioneer, we have at times led, at times collaborated, but always aimed to push the freight business toward greater efficiency, fairness, and security.

And we’re just getting started. The challenges that face the transportation world now, from capacity crunches to fraud rings to economic swings, require collaboration and innovation. Truckstop intends to remain at the forefront, as an advocate, a partner, and a solutions provider, to ensure the industry not only adapts but thrives in the years to come.

What’s Next: The Future of Freight

Looking ahead to the next 30 years, we anticipate as much change and progress as we’ve seen since 1995, if not more. Here are some key trends and developments we envision shaping the future of freight:

- AI and Predictive Analytics: Artificial intelligence will continue to improve freight matching and routing. Load boards and TMS platforms will increasingly predict optimal matches between loads and trucks (considering hundreds of variables like live traffic, historical lane rates, driver hours available, etc.), which will reduce empty miles and wait times. AI-driven forecasting will also help carriers and shippers plan for seasonal surges or slowdowns with greater accuracy, making the whole supply chain more efficient.

- End-to-End Digital Integration: We’ll see more data-sharing and integration across the industry. In the future, it’s plausible that shippers, brokers, and carriers operate on a more unified data platform, where things like capacity, pricing, and performance metrics are shared (securely) in real time. This transparency could enable dynamic pricing models for freight and more collaborative relationships, for example, a shipper might adjust its tender strategy based on live capacity data from a platform that most carriers use. Ultimately, this could bring new levels of visibility and trust, and no more information silos among market participants.

- Stronger Identity and Fraud Protections: As fraudsters get more sophisticated, so will the defenses. We anticipate things like biometric verification becoming standard, not only verifying the carrier’s representative at onboarding, but even verifying drivers at pickup through biometrics, to ensure the person taking the load is authorized. Blockchain or other distributed ledger tech might play a role in creating immutable records of freight transactions, which could cut down on double-brokering and payment scams. The industry (with Truckstop helping lead) will likely develop a federated reputation system, where bad actors are quickly identified and blacklisted across platforms. The goal is an ecosystem where trust is the default because verification is instant and foolproof.

- Empowered Small Carriers: We foresee digital tools further leveling the playing field. The smallest carriers will have access to the same quality of data and tools as mega-fleets. For example, a one-truck operator could use a future Truckstop AI assistant that acts like a virtual dispatcher. It could find loads, schedule maintenance when rates are low, manage billing, and even negotiate with brokers via AI chat. This kind of “digital backbone” for small businesses will lower the barriers to entry and success, keeping entrepreneurship alive and well in trucking. We believe the owner-operator model will continue to thrive, augmented by technology that handles the administrative burdens and lets drivers focus on driving (or even step into other roles if autonomous tech eventually reduces the need for human drivers in the cab).

Through all these changes, Truckstop is committed to building for the future with our users’ needs at the center. Our vision is to continue delivering innovative solutions that help every player in the freight ecosystem grow stronger, work smarter, and stay safer. We’re investing in many of the areas mentioned, from AI-based tools to enhanced security features to partnerships that broaden network connectivity, all with the aim of improving your experience and profitability in freight.

To every carrier, broker, and shipper who has trusted Truckstop over the past 30 years: thank you. Your partnership, perseverance, and feedback have made this journey possible. As we celebrate our 30th anniversary, we are not just looking back at what we’ve accomplished together, we’re looking forward to what’s next. The road ahead is full of opportunity and innovation, and we’re excited to navigate it with you.

Truckstop. Built for the road ahead.

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.