New Survey Data: How Carriers and Brokers Are Operating Through Uncertainty in 2026

Gain a deeper

Understanding of the spot market.

Price every load right and make more money. Truckstop's Spot Market Insights is a must-have resource.

The freight market has always moved in cycles, but the current one stands apart in important ways. As we head into 2026, most operators aren’t asking if conditions will improve—they’re asking when, and how to position their businesses in the meantime.

To better understand how the industry is responding, we surveyed more than 600 carriers and brokers in late 2025 in partnership with Bloomberg Intelligence. The findings offer a clear view into operational performance, near-term expectations, and the practical adjustments companies are making across both sides of the market. Together, they reflect an industry under sustained pressure while beginning to look ahead.

What makes this downturn feel different is its duration. Unlike past cycles that corrected within 12 to 18 months, this trucking recession has extended into a third year. Volumes and rates remain under pressure, even as sentiment shows early signs of improvement. That gap between current conditions and future expectations highlights a central challenge: preparing for recovery without committing resources too early.

Across both surveys, uncertainty emerged as a consistent theme. Many brokers remain cautious about hiring, and more than one-third of carriers are unsure about their outlook six months ahead. It’s a market moving carefully, shaped as much by what isn’t known as by what is.

Rather than trying to time the turn, the focus this year is on building operational flexibility—so businesses are ready to respond when conditions materially change.

The freight market has always moved in cycles, but the current one is testing patience in new ways. As we move into 2026, most operators aren’t asking if conditions will improve—they’re asking when, and more importantly, how to position their businesses in the meantime.

The shared reality: pressure today, cautious optimism ahead

Both carriers and brokers are experiencing the same fundamental pressures, even if the specific pain points differ.

On the carrier side, 45% reported lower volumes in Q4 2025 compared to the same period the previous year. Only 18% saw volume increases. For rates, the picture was even more challenging—just 14% of carriers experienced rate increases year-over-year, while 51% saw rates decline. When you combine falling volumes with falling rates, you get the revenue pressure that 41% of carriers reported: revenues down compared to the prior year.

Brokers faced similar headwinds. Looking at the second half of 2025, 38% reported lower volumes compared to the same period in 2024, while 35% saw volumes increase. Spot rates showed slight improvement—38% of brokers reported rates were up year-over-year, though 24% still saw rates decline. The revenue story was mixed: 37% reported revenue increases, 30% saw decreases, and 32% remained flat.

These numbers suggest stability under pressure rather than crisis. They describe a market where consistency matters, particularly as the industry continues to adjust through carrier and brokerage exits.

Where sentiment diverges from performance

Here’s where it gets interesting: despite current pressures, both groups show improving outlooks for the next three to six months.

Among carriers, 52% expect demand to increase over the next quarter, while only 13% expect it to decline. For rates, 42% anticipate increases, compared to 18% expecting decreases. On revenue expectations, 41% of carriers project growth ahead.

Brokers share similar optimism. Over half (53%) of brokers expect demand to improve in the coming months, with only 14% anticipating further declines. For spot rates, 44% expect increases versus 14% predicting decreases. And 48% of brokers anticipate revenue growth over the next three to six months.

This forward-looking optimism exists alongside current struggles. It’s not that operators are unaware of the present conditions. Rather, they’re seeing early signals or seasonal patterns that suggest the worst may be behind them.

The risk of acting too early

Improving sentiment is encouraging, but it isn’t the same as sustained performance. Optimism comes easily; committing capital does not.

As the industry looks ahead to 2026, the challenge isn’t recognizing early signs of improvement — it’s deciding when those signals are strong enough to act on. History has shown that short-term gains in rates or volumes don’t always hold. In past cycles, brief upticks have sometimes given way to renewed softness, leaving operators who moved too quickly with added pressure when conditions failed to stabilize.

That context helps explain why uncertainty shows up so clearly in the data. When 21% of brokers say they’re unsure about their hiring plans, it reflects caution rather than hesitation. When 68% of carriers say they don’t plan to purchase additional equipment in the next six months — with 32% pointing to weak demand — it signals thoughtful decision-making, not a lack of ambition. These choices reflect an industry waiting for clearer confirmation before taking on commitments that are difficult to unwind.

In many ways, the most telling signal isn’t optimism or pressure alone, but the acknowledgment of uncertainty itself. Among carriers, opinions on the broader economy are split, with some believing a recession is already underway and others anticipating one ahead. When asked to pinpoint when the spot market may reach its lowest point, responses varied widely, with “don’t know” emerging as a common answer across both surveys.

That uncertainty is shaping decisions around hiring, equipment purchases, expansion, and investment priorities. In a prolonged soft market, restraint doesn’t indicate a lack of confidence in the future. Instead, it reflects a deliberate effort to preserve flexibility, manage risk, and protect cash flow — ensuring businesses are ready to move when the market demonstrates that improvement is durable, not temporary.

How carriers are adjusting their operations

The carriers navigating 2026 most effectively aren’t the ones trying to force growth. They’re the ones protecting their foundation while staying ready to move when conditions improve.

Cash flow is the priority, not growth

In a soft market, cash flow becomes more important than top-line revenue. Loads that pay slowly or inconsistently create operational stress that compounds during weeks when freight is already scarce.

This is why predictable payment timing matters more now than during stronger markets. Carriers can’t afford to wait 30, 45, or 60 days for payment when every week’s cash flow determines which opportunities they can pursue the following week. Fast payment programs and factoring services have become operational tools rather than emergency measures—they provide the cash flow stability that allows carriers to be selective about freight rather than taking whatever pays first.

The mistake carriers make when cash flow tightens is accepting bad freight to maintain cash velocity. Hauling loads that barely cover costs just to get paid quickly creates a cycle where you’re constantly busy but never profitable. It’s the operational equivalent of running harder to stay in the same place.

Actionable considerations for carriers:

- Evaluate payment terms alongside rate per mile. A load that pays $2.10 per mile in 7 days may be more valuable than one that pays $2.25 in 45 days.

- Understand your weekly cash flow requirements and use payment tools to smooth out inconsistencies rather than letting slow pay force you into accepting unprofitable freight.

- Track which brokers and shippers consistently pay on time. Build relationships with those partners, as payment reliability is a form of operational value that doesn’t show up on a rate sheet.

Load selection is becoming more disciplined

“Staying busy” doesn’t equal profitability. This is perhaps the hardest lesson for carriers in a soft market, because the psychological pull to keep moving is strong. But running at 95% utilization with loads that barely cover your operating costs is worse than running at 75% utilization with profitable freight.

Carriers are redefining what good freight looks like. It’s not just about cost per mile—it’s about total trip profitability, considering deadhead, detention risk, payment terms, and whether the delivery location positions you for a good reload. The shift is from making load-by-load decisions based on what’s available right now to week-level thinking about which combinations of loads create profitable weeks.

Load boards should function as decision filters, not volume engines. The temptation during slow periods is to refresh the board constantly and grab anything that looks acceptable. But carriers who use boards more selectively—setting clear minimum thresholds and walking away from freight that doesn’t meet them—tend to perform better over time because they’re not training themselves to accept progressively worse freight.

Actionable considerations for carriers:

- Define your minimum acceptable parameters: rate per mile, total revenue per trip, maximum deadhead percentage, acceptable regions. Write them down. Stick to them except in genuinely exceptional circumstances.

- Calculate full trip economics, not just loaded miles. A $2.00-per-mile load with 200 deadhead miles to the next freight is worse than a $1.85-per-mile load with 20 deadhead miles.

- Track which lanes and load types consistently deliver profitable weeks. Double down on those patterns rather than chasing one-off opportunities that take you outside your operational sweet spot.

Expansion is on pause, but preparation isn’t

The survey data is clear: 68% of carriers aren’t planning equipment purchases over the next six months. Among those not buying, weak demand is the leading reason (32%), followed by equipment costs (18%) and simply not needing additional capacity after recent purchases (19%).

This pause makes sense. Adding trucks in a soft market means taking on debt or tying up capital in depreciating assets at a time when utilization is already challenging. But waiting isn’t the same as being unprepared.

Operational readiness without adding trucks means having your business systems, processes, and relationships positioned to scale when demand justifies it. It means knowing which driver recruiters you’d call, which leasing programs offer the best terms, and which lanes you’d expand into first. It means having the administrative and safety infrastructure that could support additional units without requiring you to build those capabilities under time pressure.

The carriers who will expand successfully when the market turns are the ones cleaning up their operations now—tightening dispatch processes, improving maintenance schedules, strengthening customer relationships, and building cash reserves.

Actionable considerations for carriers:

- Use this period to address operational inefficiencies. If you’ve been meaning to improve your maintenance tracking, streamline your invoicing, or formalize your lane analysis, now is the time.

- Define your expansion triggers before the market moves. What specific, measurable signals would justify adding equipment? Don’t wait to make those decisions when you’re feeling pressure to act quickly.

- Build cash reserves if possible. The carriers who can pay cash for equipment or put larger down payments avoid debt obligations that become problematic if the recovery takes longer than expected.

How Brokers Are Adjusting Their Operations

Brokers face their own set of operational challenges in 2026, with different pressure points than carriers but similar requirements for disciplined decision-making.

Margin Discipline Over Volume Growth

The survey revealed that expectations for gross margin improvement are surprisingly strong: 53% of brokers expect margins to increase over the next six months, compared to only 17% expecting decreases. This optimism exists despite current margin pressure and suggests brokers are prioritizing margin discipline over pure volume growth.

In a soft market, volume without margin is riskier than lower volume with protected margins. Taking on loads at razor-thin spreads to maintain shipment counts creates problems that compound—it trains customers to expect unsustainable pricing, it strains carrier relationships when you can’t pay competitive rates, and it leaves no buffer when accessorial charges or unexpected costs emerge.

Pricing discipline means walking away from business that doesn’t support your cost structure. It means having clear margin thresholds and enforcing them, even when that results in lower weekly shipment counts. The brokers who maintain margin discipline during soft markets are the ones who don’t have to dramatically restructure their pricing when the market tightens.

Cost control matters equally. Every dollar saved in operational expenses flows directly to the bottom line. This doesn’t mean cutting muscle—it means eliminating waste, improving efficiency, and ensuring every expense delivers proportional value.

Actionable considerations for brokers:

- Review your P&L for margin leakage. Where are you consistently losing money? Which customers, lanes, or load types systematically underperform?

- Establish minimum margin thresholds by customer segment and shipment type. Make exceptions rare and documented.

- Avoid rate wars that damage long-term viability. The shipper relationships worth having are the ones that value your service, not just your willingness to be the cheapest option available.

Productivity before headcount

The hiring data shows measured caution: 47% of brokers are adding staff, while 33% are not and 21% don’t know. This split reflects the tension between wanting to be ready for recovery and not wanting to expand payroll before revenue justifies it.

The right answer isn’t always hiring or not hiring—it’s ensuring that productivity per employee is maximized before adding headcount. A broker who hires during a soft market and then has to lay people off during the next downturn damages culture, loses institutional knowledge, and creates skepticism about future growth initiatives.

Prioritizing efficiency over scale means asking whether existing staff are working at capacity with optimized processes, or whether they’re compensating for inefficient workflows. It means investing in tools and training that increase output per person rather than simply adding more people to handle current volume.

Freight broker software and technology plays a crucial role here. Automation, load matching algorithms, streamlined communication platforms—these tools allow brokerage teams to handle more volume without proportional increases in headcount. The brokers investing in these capabilities during the soft market will scale more efficiently when demand increases.

Actionable considerations for brokers:

- Calculate revenue per employee and loads per employee. Track these metrics monthly. If they’re declining, address process inefficiencies before adding staff.

- Identify processes that create bottlenecks or require excessive manual work, like bookkeeping. Explore automation and technology solutions that eliminate those friction points.

- When you do hire, focus on force multipliers—people who improve team performance, not just individual output. Sales trainers, process improvers, and technology specialists often deliver more value than simply adding another salesperson.

Risk management and fraud prevention

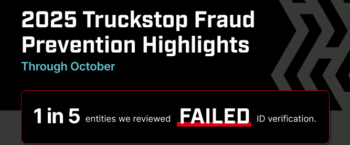

One bright spot in the broker survey: 83% feel better positioned to fight fraud than in prior cycles. This confidence matters because the operational cost of fraud in tight-margin environments can be devastating.

Fraud in freight goes far beyond stolen loads. It includes identity theft, double brokering, fictitious carriers, and schemes designed to exploit gaps in onboarding, verification, and communication. Each incident carries multiple costs: direct financial loss, strained shipper relationships, and significant internal time spent investigating, disputing, and repairing damage. According to the TIA, nearly one in four freight brokers report losing $200,000 to fraud in just the last six months.

The scale of the problem is evident across the industry. In the Truckstop 2025 Freight Fraud Report, more than 63,000 accounts linked to suspicious or fraudulent activity were blocked in a single year. That figure underscores how frequently bad actors attempt to enter freight networks — and how important early detection has become.

Prevention is significantly cheaper than recovery. The brokers who invest in verification systems, carrier vetting procedures, and operational controls reduce downstream disputes and protect already-thin margins.

Actionable considerations for brokers:

- Strengthen carrier verification and identity confirmation processes. Don’t skip steps because you’re in a hurry to cover a load.

- Use technology platforms that provide fraud alerts and carrier authentication. These tools catch problems before they become losses.

- Create clear protocols for unusual requests—last-minute carrier changes, unusual payment requests, or loads that seem too good to be true. Operational discipline reduces exposure.

Practical operating principles for 2026

Regardless of whether you’re a carrier or broker, certain operating principles apply universally in uncertain markets.

Shorten planning horizons

Annual forecasts and long-range planning work better in stable markets. In 2026, 30-to-60-day planning cycles allow you to adjust more quickly as conditions change.

This doesn’t mean abandoning strategic thinking—it means maintaining strategic direction while allowing tactical flexibility. You can still have annual goals and long-term vision. But your operational planning should reassess more frequently, allowing you to respond to market shifts within weeks rather than quarters.

What to reassess regularly: staffing levels, equipment commitments, customer mix, lane focus, pricing strategies, and cash reserves.

What to leave stable: core values, safety standards, ethical commitments, and relationship-based partnerships that transcend market cycles.

Protect cash before chasing opportunity

Cash flow is insurance against uncertainty. Businesses with strong cash positions can weather extended soft markets, take advantage of opportunities when they appear, and avoid making desperate decisions during slow weeks.

Protecting cash sometimes means passing on revenue opportunities that tie up working capital or create collection risk. It means maintaining reserves even when expansion looks attractive. It means treating liquidity as a strategic asset, not just an operational necessity.

Where carriers and brokers can reduce financial stress:

- Negotiate payment terms that match your cash flow requirements

- Use factoring or fast-pay programs strategically to smooth weekly cash fluctuations

- Build reserves during strong weeks to cover slow periods

- Avoid taking on fixed obligations (debt, leases, long-term contracts) that assume sustained volume

Avoid irreversible decisions until the market proves itself

Some decisions are easy to reverse. Hiring temporary staff, testing a new lane, or trying a different load board are low-commitment experiments. Other decisions—multi-year equipment leases, long-term facility commitments, or permanent headcount expansion—are difficult and expensive to unwind.

The question to ask before any major commitment: “If the market doesn’t recover as expected, how painful will it be to reverse this decision?”

In 2026, preserving flexibility is valuable. The businesses that maintain optionality can pivot quickly when conditions change. The ones that lock themselves into fixed structures based on hoped-for recovery may find themselves stuck with obligations they can’t support.

Use Tools as Control Mechanisms, Not Growth Levers

Load boards, factoring services, and technology platforms work best when used to enhance decision-making and operational control rather than as pure volume drivers.

Load boards should function as filters that help you find freight matching your specific criteria—not endless scroll sessions where you gradually lower standards until something is acceptable.

The best factoring companies should provide cash stability that allows you to be selective—not create dependency where you’re taking any load just to get immediate payment.

Technology should streamline processes and reduce manual work—not add complexity that requires constant attention.

The operators using these tools most effectively treat them as control mechanisms that support their operational discipline, not as solutions that bypass the need for disciplined decision-making.

What to Watch Throughout 2026

Market recovery won’t announce itself clearly. It will emerge gradually through sustained patterns rather than single data points.

Signals That Indicate Real Improvement vs. Noise

One good week doesn’t make a trend. A temporary spike in rates around a holiday or weather event doesn’t signal fundamental market change. Real improvement shows up as sustained patterns over multiple weeks:

- Volume consistency: Multiple consecutive weeks of increased load counts, not just isolated spikes

- Rate stability: Rates that hold steady or increase gradually over 4-6 weeks rather than short-term jumps

- Broader geographic impact: Improvement across multiple regions and lanes, not just isolated hot markets

- Reduced empty miles: Carriers finding backhauls more easily, suggesting better overall freight balance

- Contract rate firming: Shippers willing to lock in higher rates for guaranteed capacity

For regular market intelligence, subscribe to the Truckstop Spot Market Insights newsletter, which provides weekly analysis of freight patterns, rate trends, and capacity dynamics.

How Carriers and Brokers Should Respond Differently to Early Recovery Signs

When early improvement signals appear, carriers and brokers face different response requirements.

Carriers should focus on building volume with existing equipment before adding capacity. Test whether the improvement is sustained before making capital commitments. Strong weeks should build cash reserves that fund future growth rather than immediately triggering expansion.

Brokers can scale somewhat more quickly because adding capacity often means bringing on more carrier relationships rather than purchasing physical assets. But the same principle applies: prove the volume is sustainable before expanding headcount or making long-term commitments.

Both should maintain the operational discipline that got them through the soft market. The businesses that lose discipline as soon as conditions improve often find themselves exposed when the next downturn arrives.

Discipline Is the Advantage No One Talks About

Market cycles reward different capabilities at different times. Strong markets reward hustle, growth orientation, and aggressive expansion. Soft markets reward discipline, efficiency, and operational fundamentals.

This phase of the cycle is shaping the long-term winners in ways that won’t become obvious until the next strong market arrives. The carriers and brokers who maintain disciplined operations, protect their balance sheets, and resist the temptation to chase unsustainable volume are building competitive advantages that compound over time.

There’s a quiet advantage in being the business that stayed steady. While others cut corners to maintain volume, you maintained standards. While others took on debt to force growth, you built reserves. While others made commitments they couldn’t sustain, you preserved flexibility.

These differences seem minor quarter-to-quarter. But over several years and multiple cycles, they separate businesses that survive from those that thrive.

Operating through 2026

Nobody knows exactly when this market turns. The survey data shows improving sentiment, but sentiment alone doesn’t pay the bills or validate expansion decisions.

What we know is this: the operators focusing on clarity, consistency, and control are positioning themselves to respond effectively when conditions improve. They’re not paralyzed by uncertainty—they’re using it to make better decisions.

Clarity means understanding your true costs, your actual margins, and the specific signals that would justify changing your operational approach.

Consistency means maintaining standards for freight selection, customer relationships, and operational quality regardless of volume pressure.

Control means managing cash flow proactively, using tools strategically, and preserving the flexibility to adjust as markets change.

2026 won’t reward the boldest predictions or the most aggressive growth plans. It will reward the operators who built sustainable operations that can weather uncertainty without sacrificing long-term viability.

The market will turn when it turns. Until then, the best approach is to stay disciplined, stay ready, and let the market prove itself before you commit to what it might become.

Truckstop.com gives you the tools to maintain stability and choose the best loads for your truck. Our load board, rate analytics, and payment solutions help carriers and brokers operate with confidence through every market cycle.

FAQs

This report draws on data from two comprehensive surveys conducted by Bloomberg Intelligence and Truckstop in late 2025. The broker survey, fielded during the second half of 2025, represents the 20th semiannual edition of this ongoing industry research. It captured responses from 187 freight industry professionals, including freight forwarders, third-party logistics providers, broker agents, and both asset-based and non-asset-based brokers. Companies with 1-50 employees accounted for 68% of respondents, with broker agents representing the largest segment at 35%, followed by non-asset brokers at 32% and third-party logistics providers at 16%.

The carrier survey, conducted in Q4 2025, marked the 66th overall survey and the 42nd quarterly edition since transitioning from monthly tracking. This survey gathered insights from 428 owner-operators and small fleet operators across multiple equipment types, including dry-van, flatbed, temperature-controlled, specialized, hot-shot, and step-deck carriers. Flatbed operators represented the largest equipment category at 58% of respondents, while 55% of participants operated just one tractor, providing direct insight into the small carrier segment that forms the backbone of the spot freight market.

Together, these surveys represent over 600 freight professionals and offer a comprehensive view of current market conditions from both the capacity and brokerage perspectives.

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.