Semi-Truck Insurance: How to Navigate the Challenge of High Costs

What are you waiting for?

Find capacity and increase margins starting now.

Running a fleet is expensive, making cost-management crucial to your profitability. For freight carriers, one of the biggest expenses is semi-truck insurance. Recently, premiums have been rising due to several complex factors. Understanding what factors drive these increases is essential to managing them.

While cost-cutting is possible in other areas, reducing semi-truck insurance can be tricky. Lower premiums often mean weaker coverage, leaving your fleet vulnerable.

We’ll explore the rising cost of semi-truck insurance, break down key coverage elements, and offer actionable strategies for carriers to optimize their insurance spending.

Understanding semi-truck insurance costs

There isn’t a single insurance policy for semi-trucks; several are needed to ensure the right coverage.

Here are a few of the most common coverages.

Contingent cargo insurance protects against losses related to transported goods. If goods are lost, stolen, or damaged in transit, cargo insurance covers any physical losses.

Professional liability (E&O), also known as Errors and Omissions, protects against business operations mistakes. These mistakes could be incorrect shipping details or a failure to secure the proper permits. These errors can lead to financial loss, and this insurance will cover any court costs, attorney fees, and settlements you are legally required to pay.

Third-party liability/contingent auto insurance helps cover you for any commercial vehicles you don’t own.

General liability helps to protect against any claims related to bodily injuries and property damage.

Worker’s compensation covers any employees who get sick or injured on the job, so you get financial support for lost wages, medical expenses, rehabilitation costs, and more.

Why Semi-Truck Insurance Costs Are Rising

Semi-truck insurance costs have substantially risen over the last several years. The rise in costs impacts everyone in the trucking industry: smaller carriers pay almost 90% more per mile on premiums, high dollar verdicts against larger companies have increased 51.7%, and the shortage of trucking insurance companies is making it harder for all companies to get adequate coverage.

Several key factors impact the rising semi-truck insurance costs:

Costs of parts

To keep a fleet on the road, you need to maintain your vehicles, and as they get older, new parts are often required. With the technological advances in new trucks, if parts need replacing, they often come with a higher price tag due to their complexity.

Global supply chain disruptions are making parts harder to find and more expensive. The increase in replacement costs translates into higher insurance premiums since insurers need to cover the increased value.

Medical expenses

Medical care continues to get more expensive, directly impacting insurance costs. Since accidents can lead to high medical bills, insurers raise premiums to cover these potential costs.

Litigation and legal abuse

Lawsuits in the trucking industry are becoming more common, and settlements are rising. Insurers raise premiums to protect themselves from these potential legal claims and expenses.

Turnover rates

The trucking industry’s driver turnover rates are high, between 70% and 90%. This leads to more inexperienced drivers on the road, a higher risk of accidents and claims, and higher insurance premiums.

How rising insurance costs affect brokers and their operations

The rising costs of semi-truck insurance are putting a strain on brokers in several ways:

Higher operational expenses: Brokers must cover these increased insurance premiums to protect against liability and operational risks.

Strained carrier relationships: To offset the increasing insurance costs, carriers may be forced to negotiate higher rates or reduce the volume of business they can handle, leading to challenges to maintaining reliable carrier networks and consistent service levels for clients.

Pressure to improve safety standards: Brokers may need to push carriers to adopt stricter safety standards to reduce accidents or claims, which can help lower insurance terms. But this may cause added stress to the relationship.

Strategies to manage increasing insurance costs

Rising insurance costs present significant challenges, but you can manage and even reduce them with appropriate strategies. Here are some practical tips:

Leverage technology for operational efficiency.

More hours spent on the road by your drivers means more risk of accidents and more wear and tear on your vehicles. This can lead to higher insurance rates and worse terms. Technology, like a transportation management system (TMS), can help optimize routes, increasing efficiency and decreasing drive hours, which could lower premiums.

Digital freight matching platforms are also great for optimizing load assignments and ensuring carriers operate efficiently. These platforms can reduce idle time and improve overall asset utilization, contributing to a lower risk profile and potentially lower insurance costs.

Use newer trucks.

The age, condition, and value of trucks are significant factors that affect insurance premiums. Trucks that are ten years old or newer are equipped with more modern equipment, making them less likely to break down and safer. Insurance companies consider the age of the vehicle and will reduce insurance rates because these vehicles are a lower risk.

Keep driving records clean.

An unclean driving record is sure to increase insurance rates. Even minor infractions like running a red light or speeding can impact insurance costs. To help drivers keep their records clear, consider a reward system. If a driver can go a certain period without an incident, they can get a monetary reward, which will be smaller than the potential increase in insurance rates.

Use one insurance company for your entire fleet.

You may be paying unnecessarily high rates if you use multiple insurance companies for different vehicles. Consolidating all your insurance with a single provider often secures discounts and lower rates. Having one insurance provider also simplifies tracking payment schedules, where late payments can impact your insurance rates.

Understanding the factors driving up insurance costs helps freight professionals implement proactive strategies that can help them navigate the changing market and achieve profitability.

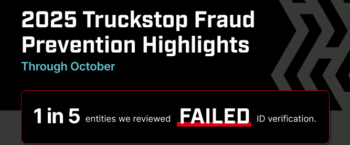

Truckstop offers carrier insurance monitoring so you can find, qualify, and monitor carrier authority, insurance, safety ratings, and CSA-e percentile scores. To learn more, schedule a demo with one of our experts.

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.