Double brokering prevention strategies under new FMCSA rules

Gain a deeper

Understanding of the spot market.

Price every load right and make more money. Truckstop’s Spot Market Insights is a must-have resource.

Double brokering is getting worse in the freight industry. It costs up to $35 billion every year in losses.

The Federal Motor Carrier Safety Administration (FMCSA) is rolling out new rules to stop it. These updates push for more transparency, better security, and real accountability. The goal is to protect brokers and carriers from cargo theft and payment disputes. These rules also help protect your reputation by stopping double brokering before it happens.

Here’s what you need to know about the new FMCSA double brokering regulations. We’ll cover how to spot double brokering attempts, ways to prevent it, and how technology helps protect your operation.

What is double brokering fraud?

Double brokering freight fraud happens when a carrier accepts a load from a broker, then re-brokers it to another carrier without the shipper knowing. Legal co-brokering involves everyone agreeing upfront and writing it into the contract.

Illegal double brokering is shady and unauthorized. Instead of the original broker assigning a load to a vetted trucking company, an unauthorized middleman steps in and takes over.

Sometimes legitimate brokers hand freight to fraudulent people without knowing. Other times, someone pretends to be a carrier to get on load boards, then reassigns those loads for profit.

This creates an extra layer in the transaction. It gets hard to track the shipment or figure out what went wrong. The original broker thinks the load is with a trusted carrier. Instead, it got handed off to someone else. This leads to missed deliveries, freight fraud, or cargo theft. The shipper and original broker don’t know who the actual carrier is until something goes wrong.

Why it’s a serious issue

Double brokering creates liability for people who did nothing wrong. Carriers end up delivering loads without getting paid. Insurance coverage gets voided. It breaks FMCSA regulations and brings serious legal trouble. This is especially true when loads move through unauthorized or unlicensed people.

What starts as a simple mistake or shortcut turns into a big problem fast. More than an operational headache, double brokering leads to:

- Lost or stolen shipments

- Unclear insurance liability, with policies voided when unauthorized brokers get involved

- Damaged trust between brokers and carriers, breaking down working relationships

- Payment disputes when multiple people claim pay for the same shipment

- Legal exposure under FMCSA regulations and transportation insurance policies

- Audits and fines from logistics compliance failures

- Legitimate freight brokers dealing with disputes about their broker bonds, affecting their credit and professional standing

- Damaged client relationships and big financial losses

The lack of transparency in double-brokered loads breaks down the supply chain. Shippers need accurate load tracking and custody documentation to plan deliveries and protect against risk. Those safeguards collapse when a load goes to another party without anyone knowing.

Legal co-brokering vs. illegal double brokering

The main difference between co-brokering and double brokering comes down to communication. Co-brokering is legal and transparent between two licensed brokers. It gets used to move specialized freight or cover a new lane. Illegal double brokering involves deception and no authorization. One party stays in the dark, not knowing the load went to an unauthorized third party.

Knowing how to work together legally matters for building a more secure, transparent supply chain. For legal co-brokering to work, the shipper and everyone involved needs to know about and agree to the arrangement. This agreement needs clear documentation written into contracts.

How to spot double brokering attempts

Fraudsters keep evolving, but they often leave behind certain red flags. Brokers and carriers should treat these as warning signs to dig deeper:

- Mismatched contact information: You might be dealing with a scammer if their email domain is a generic provider like Gmail or Yahoo instead of a company domain. Phishing and smishing scams often use these tactics to appear legitimate..

- Unusual pressure or urgency: If someone tries to pressure you or demands to dispatch the load right now, it’s a scammer trying to skip a thorough vetting process.

- Suspiciously high rates: Dig deeper if you get an offer that seems too good to be true. Be skeptical of loads from brokers you’ve never worked with or those who seem desperate to move freight. Fraudsters often throw out high rates to get carriers to accept loads that never pay out.

- Refusal to provide driver information: Another warning sign is when someone hesitates or refuses to give their driver’s name or contact number.

- Last-minute equipment changes: A carrier showing up with different equipment than what was agreed on in the carrier packet is a big warning sign.

- Multiple calls from different people: If you get calls about the same load from different people at different companies, the load got re-brokered multiple times.

While fraudsters are evolving, they often leave behind a trail of certain red flags. Brokers and carriers should see these as warning signs to investigate deeper:

New FMCSA double brokering regulations

New regulations are coming out to prevent freight fraud. From better transparency to improved freight verification under FMCSA rules, these updates aim to fight double brokering and protect everyone in transportation:

Identity verification and registration

New FMCSA rules require a government-issued photo ID and a live facial selfie to register. This keeps shady operators from gaining authority. The agency also verifies business addresses to stop companies from using fake addresses for registration. Multi-factor authentication is expanding too, making accounts more secure.

The FMCSA is phasing out MC numbers and moving to a single USDOT number system. The change requires all carriers, brokers, and freight forwarders to use only their USDOT number for identification. With a single identifier, fraudulent people face a much harder time reopening under a new name with a different MC number after getting shut down.

Stricter financial oversight

The FMCSA is creating a tougher vetting process to check a broker’s long-term financial stability. It aims to keep financially unstable people or fraudsters out of the system. In the long run, it should create a fairer space for everyone in the supply chain.

The FMCSA stepped up its financial review process for broker applicants. Under the regulations, brokers need to refill their funds within seven days if their financial security drops below $75,000. If they can’t do this, their operating authority gets suspended right away. The change protects carriers from nonpayment by brokers. It makes sure brokers have the financial backing to meet their obligations, reducing risk for carriers.

Greater broker transparency

The FMCSA is focusing on better transparency. A big update requires brokers to provide their electronic transaction records to carriers within 48 hours of request. Carriers will get faster access to the financial details of their loads. Contracts that force carriers to give up their rights to access these records will be banned.

To adapt, brokers need to keep electronic records and retrieve requested information quickly. This update gives carriers a clearer view of the money earned and spent on their loads. It helps them negotiate better rates and avoid unfair deductions.

Enforcement and penalties

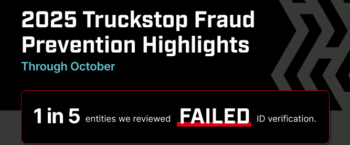

The FMCSA launched a dedicated registration fraud team to spot and stop fraudulent operations. The agency is reviewing the carrier network on an ongoing basis, hoping to crack down on scams like double brokering. They’re introducing new legislation giving them more authority to penalize companies that commit fraud. New legislation also lets states use federal funds to enforce consumer protection laws related to freight transportation.

Prevention tactics for brokers

To build a solid operation, you need safeguards in place before problems show up. Set these into motion and you stop risks before they happen:

- Thorough carrier vetting: Start using a tougher process when vetting carriers. It should include a full FMCSA check and document verification. Use a strong risk scoring system for every carrier.

- Standardized onboarding: Create detailed onboarding checklists for a more consistent carrier approval process. This helps you catch things before they slip through.

- Proactive carrier monitoring: Watch carrier behavior all the time. Note red flags like frequent cancellations, sudden routing changes, or unusual activity.

- Technology: Use systems that spot unusual load reassignments or problems in real time. Many platforms give you early warnings.

- Staff education: Train your team to recognize common fraud red flags, including fuel card scam indicators and other financial fraud tactics. Have a clear plan to deal with suspected ones. Turn to resources like the Transportation Intermediaries Association to prevent scams and train your team.

- Contractual safeguards: Add specific clauses to your shipping contracts, like a “no re-brokering” clause. Outline the penalties clearly in your contracts.

- Multipoint verification: Go beyond an initial check. Cross-reference phone numbers, emails, and physical addresses to make sure all your carriers are legitimate. Confirm identification through the Safety and Fitness Electronic Records (SAFER) system on the FMCSA website. If the number the carrier gave you doesn’t match the number posted, call the number in SAFER to have the company discuss the load. This tells you if someone stole the identity of an employee.

- Maintaining a “do not use” list: Keep an internal registry of carriers flagged for fraud.

- Regular auditing: Do routine audits to review your carrier base, searching for dormant or suspicious patterns.

Prevention tactics for carriers

As a carrier, you need a watchful approach to protect your operation from double brokering. Doing your homework goes a long way in protecting your operation and making sure you get paid on time. Key prevention tactics include:

- Verify broker authority and credit: Always use the FMCSA database to confirm a broker’s operating authority. Make sure it’s active and legitimate. Use credit-checking services to review their payment history and reliability. This helps you determine if you’re working with reputable people. Make sure the broker has their $75,000 surety bond by checking their USDOT number. Do regular checkups because statuses change.

- Thoroughly scrutinize rate confirmations: Review every rate confirmation sheet you get. Make sure it includes the broker’s full contact information, including their physical address. Every document should outline who pays and lay out the full terms of the agreement. Any missing information or vagueness is a red flag.

- Cross-reference all information: Never accept information at face value. Cross-reference the broker’s contact details with official records like the FMCSA SAFER system. This verifies their identity. Look for consistency across all platforms and publicly available information.

- Document everything thoroughly: Keep full records of all communications, rate confirmations, and any changes to load details. These documents matter if a dispute comes up because they provide clear evidence of agreements and discussions.

- Trust your instincts: If anything about a load or broker seems suspicious or raises doubts, be cautious. A legitimate broker will understand your need for full transparency and verification.

Using technology to secure your shipments

In the freight industry today, technology is a must to properly secure your shipments. The right features give you extra protective layers from fraud:

Real-time shipment tracking

With GPS and electronic logging device (ELD) data, you get proof of which truck is moving cargo. With real-time visibility, an unauthorized carrier faces a nearly impossible task trying to take over a load without getting caught. Any change from a planned route or scheduled stop gets flagged and shows up right away.

Digital onboarding platforms

Automated digital onboarding platforms work as strong fraud prevention tools. They connect with FMCSA databases and flag problems in a carrier’s authority, insurance, or safety ratings right away. You monitor these details in real time and get a much faster, more accurate vetting process than with a manual check.

Secure load board environments

Choose a closed-network or heavily vetted load board to reduce risk. In these controlled spaces, members get monitored all the time for compliance and performance history. They create a more secure marketplace where fraudulent actors face a much harder time getting in.

Protect your business with Truckstop.com

Double brokering affects your profit margins, reputation, and cargo safety. To handle the new FMCSA rules and protect your operation, you need strong, reliable tools. Truckstop provides the technology and network needed to keep your operations safe.

Truckstop RMIS Carrier Onboarding is a leading tool that offers ongoing compliance monitoring and support. It lets you connect with only a secure network of vetted, compliant carriers and owner-operators. Check carrier authority with ease, track insurance, and access safety ratings all in one place.

Truckstop helps your operation thrive as regulations keep changing. Request a demo today to see the difference.

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.