What is the Cost of Factoring? 3 Ways to Lower Costs

With freight factoring, you sell your invoices to a factoring company. The factoring company pays you (minus a per-invoice fee) within 24 hours and then handles the collections for you.

When you are deciding which trucking factoring company to go with, however, there are several factors you will want to consider.

Start Factoring your loads.

You focus on hauling freight; we’ll handle the rest.

Factoring cost vs. factoring rate

When determining the cost of factoring, you need to know that there can be a big difference between the factoring cost and the factoring rate.

When comparing truck factoring companies, one of the first things most truckers do is look at the rate. However, the lowest rate might not produce the lowest expense. When deciding which factoring company to choose, you want to look at the true cost of factoring receivables and not just the rate.

Some freight factoring companies often charge additional fees, which can add up quickly. These additional charges might wind up costing you more than if you went with a company that charges a higher factoring rate.

How are factoring costs determined?

Rates are only one part of the equation. The cost of invoice factoring includes several variables, including the overall volume of the risk profile of your customers.

- Volume: How much do you plan to factor each month? Typically, the more invoices you factor, the lower your rate. Some factoring companies will offer tiered rate plans, which means your rates can reduce as your volume grows.

- Invoice size: Your invoice amounts may also affect the cost of invoice factoring. It takes the same amount of time for a factoring company to process a small invoice as it does a large one.

- Industry: Factoring companies can handle invoices across many industries, and structure rate offers based on industry norms. While things like construction or healthcare have higher risks, transportation has lower risks. You will get the best rates when you work with a company specializing in freight factoring.

- Risk: Truck factoring companies want to reduce their risk as much as possible. The higher the risk, the higher the rates. Factoring companies will want to evaluate the quality of your customers and the diversity of your portfolio.

- Customer credit: Freight factoring companies aren’t looking at your credit rating, but they will take a look at your broker’s credit. If the brokers have good credit ratings and typically pay their bills on time, you are likely to get a better rate. Conversely, the worse the creditworthiness of your customers, the higher rates you will likely be charged.

- Payment turnaround time: There is less risk for factoring companies if brokers pay on time. Lower rates go to the best clients. If brokers take longer than industry averages to pay or let some bills go past due, it can affect your rate. In some cases, factoring companies charge additional fees for unpaid invoices beyond contracted periods.

- Business stability: The cost of factoring invoices can also depend on the strength of your business. Whether you are an owner-operator or have a fleet of vehicles, newer trucking companies might pay higher rates to start.

- Additional fees: Additional fees can add up quickly, so review them carefully in any factoring agreement. Some freight factoring companies roll extra fees into the factoring rate, while others add fees on top of your rate. Additional fees might include application fees, onboarding fees, invoice processing fees, ACH or wire transfer fees, payment fees, monthly maintenance fees, fuel advance fees, or monthly minimums.

How much do factoring companies typically charge?

The average cost of factoring invoices is typically between 1% and 5%, depending on these variables. Remember, the factoring rate is just part of what you may end up paying. The more invoices you factor, the more you’re billing. The better your customer’s credit is, the lower rates you’ll pay.

Types of freight factoring rates

There can also be a difference in the freight factoring rates depending on how your agreement is structured.

Flat rates

Flat rates are the most common in the trucking industry. You pay a one-time fee when the invoice is processed, which does not change no matter how long the invoice goes unpaid.

Your rate may vary depending on whether you use a factoring company that offers recourse factoring or non-recourse factoring. With non-recourse factoring, the factoring company takes on the risk of collections. You still get paid if a customer doesn’t pay their bill due to credit insolvency. In recourse factoring, you might have to buy back the invoice if it’s not paid within a specific time.

Variable or tiered rates

Some factoring companies use a variable rate or tiered rate formula to adjust rates depending on how long it takes your customers to pay. For example, they may charge a 2% factoring fee for the first 30 days and add another half percent every 10 days or two weeks.

You are paid a percentage of the invoice when you submit it with this type of rate. Once the broker pays the invoice, you get the remaining amount, minus the factoring and other fees.

How to calculate your freight factoring cost

To calculate the true cost of factoring receivables, let’s compare two different funding examples with the same amounts with different factoring rates:

Example 1

- Invoice amount = $1,000

- Freight factoring rate = 3% ($30)

- You get $970

Example 2

- Invoice amount = $1,000

- Freight factoring rate = 5% ($50)

- You get $950

What is the potential cost of not factoring?

Factoring puts money in your pocket faster. This lets you pay your bills and employees, handle maintenance, and fund fuel costs for more loads rather than waiting until your customer pays you. Some companies will take 30, 60, 90 days, or more to pay, which can hurt your cash flow.

When you don’t factor your invoices, you are also responsible for billing and collections. If companies are slow to pay, you also have to chase payments. These administrative tasks take up time you could be spending hauling loads and making more money. Rather than calling or emailing to find out when you get paid, having to pay out of pocket for expenses, or working with collection agencies to get paid what you are owed, you can keep on the road and earning.

How can you lower freight factoring costs?

There are ways you can lower your freight factoring costs. The big decision is which company you choose because some factoring companies will charge several fees on top of the factoring rate. Others will lock you into contracts with expensive buy-out clauses. These “hidden costs” can lead to big surprises when you get paid.

This is why it’s so important when comparing factoring rates to look at all of the variables that can cost you money.

To lower your freight factoring fees, choose a company that:

- Provides flat fees

- Does not require a minimum volume

- Provides non-recourse factoring

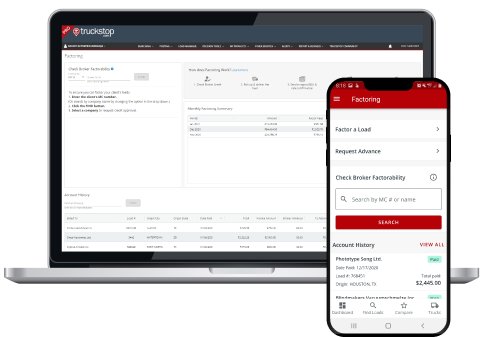

With Truckstop Factoring, you get all three. Truckstop charges a flat fee, so you always know what you will pay with no surprises. There are no minimum volume requirements, so you can factor as many or as few invoices as you want each month. Truckstop also provides non-recourse factoring, so you still get paid if a broker does not pay due to credit insolvency.

Reduce factoring costs and get paid faster.

With Truckstop Factoring, you can reduce your factoring costs and get paid faster. Plus, you get full-service billing, flexible cancellation policies, and paid faster at no additional charge.

Get helpful content delivered to your inbox.

Sign up today.

Find high-quality loads fast, get higher rates on every haul, and access tools that make your job easier at every turn.