Cargo Insurance

PER-LOAD insurance for both LTL and full truckload.

Protect your cargo and your bottom line.

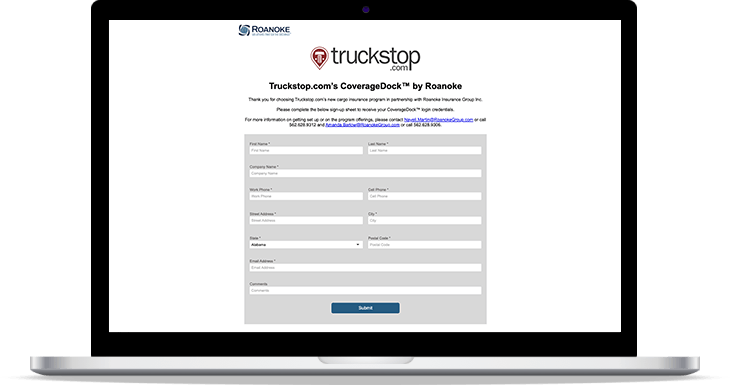

Get the insurance that puts you in the driver’s seat. Truckstop’s new cargo insurance program in partnership with Roanoke Insurance Group Inc. is the coverage solution for all your cargo needs. CoverageDock by Roanoke offers:

24/7 Direct Access

Direct access 24 hours a day, 7 days a week.

Automated OFAC Sanction Screening

Issue Cargo Insurance certificates with automated OFAC sanction screening.

Real-time Notification

Real-time quote request and referral notification.

Automatic Insured Shipment Reports

Insured shipment reports are generated automatically – eliminating manual reporting.

Sign up now to get set up with CoverageDock by Roanoke.