A Truckers’ Tax Guide: Tips to Save Money and Maximize Deductions

Download the full checklist to take control of your finances and keep more of your hard-earned money this tax season.

By downloading this checklist you, agree to Truckstop’s Terms and Conditions and Privacy Policy.

In an industry where uncertainties are the norm, one thing remains consistent, and it rolls around the same time every year: Tax season.

And while many truck drivers and independent owner-operators can feel overwhelmed because they most likely didn’t sign up to do loads of paperwork and play CPA in their spare time, it’s still imperative to know the basics and be prepared when the IRS comes knocking. It doesn’t have to be stressful.

When you know the deductions owner-operators are allowed to claim, keep track of your expenses throughout the year with some basic recordkeeping, and plan ahead, you can face tax time with a lot more confidence and a lot less dread.

“You can’t manage your business if you’re not keeping track of it throughout the year….Keep up with it every day, every month, and at the end of the year.”

Todd Amen, President and CEO at ATBS

In addition to state and federal income taxes, truck owner-operators are required to pay the trucking fuel tax known as IFTA, the International Fuel Tax Agreement. As an owner-operator, you must register in your base state and report and pay that state accordingly. IFTA taxes can be confusing, so make sure you understand the ins and outs.

You can always hire a tax professional to help you, depending on your comfort level. Even so, careful and thorough recordkeeping on your part will ensure a smooth process and help you avoid over-paying or owing money when you least expect it.

Most common tax deductions

If you’re an employee of a trucking company and receive a W-2 at the end of the year, your job-related expenses are not tax deductible. If you’re a self-employed owner-operator, however, you can and should deduct all your work-related costs.

As an owner-operator, at the end of the year you will get a 1099 tax form from customers that paid you more than $600 throughout the year. Those forms, plus your own records of income and expenses, are what you report and file along with your 1040.

Again, keeping good records and careful documentation will help you back up your deduction claims to ensure you get the full tax benefits and help you avoid an audit.

Vehicle-related expenses

The IRS considers your equipment—your semi-truck, van, flatbed, reefer, or other type of vehicle used in your trucking operation—to be a qualified non-personal-use vehicle. You can claim all the actual expenses of operating the vehicle as deductions.

- Fuel costs: Any fuel costs you pay on the road hauling loads, along with the fuel taxes you’re responsible for when filing your quarterly IFTA report are tax deductible. You can also claim work-travel-related fees like tolls and parking.

- Maintenance and repairs: Since your truck is considered a qualified non-personal-use vehicle, you can deduct 100% of all vehicle expenses for truck repair and maintenance. A simple rule of thumb is “if you repair it, you can deduct it.” Maintenance and repair expenses on your truck, including labor, parts, oil, tires, tools, and getting your truck washed and detailed can be deducted in full the same year you paid for it. Make sure you keep every receipt, whether the expense is large or small. They all add up come tax time, and you can’t claim it if you didn’t document it.

- Truck payments or leases: Whether you have truck payments on a vehicle you’re working to own or if you lease your work vehicle, those payments are fully deductible.

If you own your truck, you can claim depreciation. “Straight-line” depreciation is the standard schedule for a new Class 8 truck, and it’s spread evenly over several tax years. Accelerated depreciation takes a percentage of the truck’s value in a couple of years and a less rate after that. - Insurance premiums: Business-related insurance premiums, including equipment insurance, can be deducted from your taxable income. This includes commercial liability insurance, property damage insurance, business interruption insurance, and loss of cargo insurance.

- Registration fees and taxes: Any expense directly related to your independent owner-operator business is tax deductible. This might include:

- Vehicle registration fees

- Permits

- Licenses and taxes, including the Heavy Highway Vehicle Use Tax and the cost of maintaining your CDL

Travel expenses

- Lodging (hotels, motels): If you’re working away from home long enough to need overnight accommodations, you can claim the lodging bill as a tax deduction.

You can also claim expenses incurred with furnishing your sleeper berth. Items that fall under this category might include a mini-fridge, coffee maker, window coverings, bedding, food storage items, and first-aid supplies. - Meals (subject to partial deduction): If you’re an owner-operator driver subject to hours of service regulations, you can claim 80% of meal expenses purchased on the road. You have two options: You can either keep all your food and restaurant receipts and claim your actual meals expenses, including tax and tips, or you can use the per diem allowance. Per diem is the daily non-taxable reimbursement the federal government allows to cover meals and incidentals on the road. The IRS uses the official General Services Administration per diem rates.

- NOTE: Effective October 1, 2024, the U.S. per diem rate for a full day increased to $80, up from the previous rate of $69, which was in effect from January 1 to September 30, 2024. This means that when you file your 2024 taxes, you will calculate your per diem rate using two different rates.

- Shower fees at truck stops: Many truck stops are conveniently equipped with showers for on-the-road hygiene purposes. Some charge, some don’t. If you pay for this convenience, you can claim it as a tax deduction.

Equipment and supplies

- Devices: Today’s mobile technology is essential to running an efficient and compliant trucking operation and helps independent owner-operators compete with large carrier companies. From GPS devices to tablets, smartphones, and laptops, the cost of these business tools is a tax deduction that will lower your tax bill. If you use the technology for both business and personal reasons, deduct the portion that’s work-related.

- Logbooks: If you keep a manual record of any business transactions, expenses, hours of service, or any other work-related topic, you can deduct the actual cost of the journal or logbook.

- Safety equipment: Any specialized safety gear required for your job, like safety goggles, steel-toed boots, a back brace, or other article designed to protect you while working, can be deducted.

- Work-related clothing and laundry: Everyday clothing (such as jeans and a t-shirt) cannot be deducted, even if you wear it while driving. However, specialized clothing, like coveralls, specialized footwear, or protective headwear can be deducted. A company logo shirt or other garment that represents your company can be deducted.

Home office and communication expenses

- Cell phone bills: If you have a separate cell phone that you use exclusively for your trucking business, you can deduct the entire cost of the plan. If you use one phone for both personal and business use, you can deduct a portion of the cost. You will need to determine what percentage of the time you use it for your trucking operation and deduct that portion. Today’s owner-operators rely on trucking-related apps to run their businesses and find loads. Any and all apps you use to handle any portion of your business can be written off as a tax deduction. Again, keep a record of your purchases and related costs so you can easily itemize them and take the deductions at tax time.

- Internet services for work purposes: If you have Wi-Fi at home or in your cab, you can deduct the cost on your taxes. Wi-Fi in your cab lets you work from anywhere—whether it’s planning your next haul, finding loads, or handling other online tasks.

- Home office supplies: If you conduct portions of your business from home, like most owner-operators do, make sure you deduct office supplies. Items like printer paper, printer ink, staplers, notebooks, and pens and pencils may seem like small deductions, but they all add up to help keep your tax bill as low as possible.

- Health and medical expenses

- DOT physicals: As a condition of employment, you may be required to get regular medical exams, as required by the DOT. You can deduct any out-of-pocket expenses for these required physical exams.

- Sleep apnea tests or other medical tests related to your job: You can claim any out-of-pocket medical expenses that are work-related. This might include sleep apnea tests,

- Health insurance premiums (if self-employed): If you cover the cost of your own health insurance, you can deduct it from your taxes. It’s not considered a business expense, but there’s a designated section on your tax return to claim health insurance payments.

Professional fees

- License renewals: You can deduct the cost of renewing any licenses required to conduct your business, including state and local government-required business licenses.

- Association memberships: If you belong to any trucking-business-related or freight-industry organizations that charge a membership fee, that fee is tax deductible.

- Subscriptions to industry publications: If you subscribe to any magazines or websites focused on the trucking industry, you can deduct the full cost of those subscriptions.

Are you leaving money on the table?

Tune in to the Freight Nation podcast to uncover often-missed deductions and tips to help you maximize your earnings.

Non-deductible expenses

While most business-related expenses are deductible, some are not. These, in particular, are not:

- Reimbursed expenses: If someone else pays you back for your expenses, you can’t turn around and claim that expense on your taxes.

- Home or personal cell phone: A landline or personal cell phone not used for business purposes cannot be claimed as a tax deduction.

- Commuting expenses: If your truck is not parked where you live, you can’t claim the mileage you drive between home and where you start your work trips.

- Local route meals: If you’re driving local routes close to your home, daily meals are not deductible.

- Everyday clothing: Even if you wear it while driving, everyday clothing like jeans and T-shirts cannot be deducted.

- Personal trips: You cannot deduct the costs associated with personal trips or vacations, even if you’re using your business vehicle. For tax deductions to apply, the trip must be for the sole purpose of actively working.

Best ways for tracking deductions

- Use a dedicated business bank account and credit card. Keep your work and personal finances separate. This is the easiest way to track your income and business-related costs and will make life—and tax time—much easier for you and any tax professional who’s assisting you.

- Implement a digital receipt management system. Keeping track of physical receipts can get messy. An easier way, and one that’s less prone to loss and human error, is to use a digital receipt management system, especially if you primarily use a debit or credit card to pay for expenses.

- Utilize mileage tracking apps. Mileage tracking apps are an excellent way to keep track of your mileage. This eliminates the need to manually write down your mileage, which can be time-consuming, less accurate, and subject to human error—like forgetting!

- Maintain a detailed logbook (physical or digital). Documentation is key! Whether you do it manually in an actual notebook or use a digital solution, you’ll have no regrets when tax time rolls around. If you use a physical logbook, consider one with a pocket insert or built-in folder to keep your receipts organized and all in one place.

- Set up a filing system for organizing receipts and documents. A good rule of thumb is to organize receipts and documents by year. Since it’s recommended to keep records up to three years back, this is a good way to easily retrieve what you’re looking for at any given time.

- Use accounting software designed for truckers. Keeping track of paperwork and staying on top of finances can be time-consuming and daunting. Consider using accounting software specifically for trucking. It dramatically reduces paperwork, automates tedious processes and frees you up to focus on finding loads and driving.

- Consider hiring a bookkeeper or accountant familiar with the trucking industry. If you’re in the market for a bookkeeper or accountant, seek one with freight industry knowledge and/or experience, like ATBS. This will ensure you claim all the deductions you can, minimize your taxes, and avoid an audit.

“Get an accountant and get a system that tells you what your actual number should be based on what you’re actually earning. An easy thing to do is save 20% of what you get every week, what your net is, and put it in an account that you’re not going to touch. And that’s ultimately what you’re going to pay in taxes and use that for your quarterlies.”

Todd Amen, President and CEO at ATBS

Tips to minimize your taxes

- Maximize retirement contributions (e.g., IRA, SEP IRA, Solo 401(k)).

- Take advantage of per diem rates for meals and incidental expenses.

- Keep detailed records of all business-related expenses.

- Stay informed about tax law changes affecting the trucking industry.

- Consider incorporating your business or forming an LLC.

- Plan major purchases strategically (Section 179 deduction).

- Consult with a tax professional specializing in trucking industry.

“If you can do it, take 10% of every dollar you make and put it in a retirement account. It’s tax deductible and saves you money on taxes. It’s also going to grow with what it’s invested in. A retirement account is a great thing to do. Be disciplined and put 10% of what you make in a retirement account, and you’ll retire early.”

Todd Amen, President and CEO at ATBS

Important reminders

- Keep all receipts and documentation for at least 3 years.

- Separate personal and business expenses.

- Be aware of the difference between deductible and non-deductible expenses.

- Stay up-to-date with IRS guidelines for truck drivers.

- We strongly recommend making estimated quarterly tax payments to avoid steep penalties and unwelcome surprises. Experts suggest setting aside 20 to 30% of your income for taxes.

Tax checklist for owner-operators

Getting started

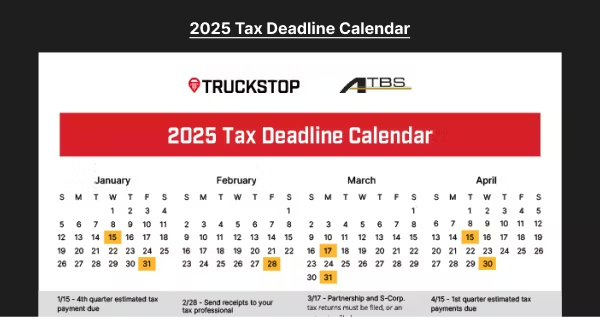

- Familiarize yourself with tax schedules, including filing deadlines, payment schedules, and IFTA requirements.

- Know the deductions you’re allowed to claim and keep thorough records of the following expense categories throughout the year.

- If you have a high-deductible health plan, consider contributing to a health savings plan (HSA), which is considered pre-tax income. HSA funds remaining at the end of the year can be rolled over.

- Consider making contributions to retirement accounts, such as an IRA account. This will help reduce your taxable income.

- Prepare 1099’s if you used contractors during the year. If you paid someone who doesn’t officially work for you, such as a subcontractor, $600 or more, you must provide them with a 1099-NEC form to be completed and filed by January 31 of the new year. It’s a good idea to handle this early to avoid any last-minute issues.

- A tax professional can ease the burden and pressure that comes with keeping track of critical dates and required filings. Consider hiring a tax accountant to help you meet deadlines, avoid penalties, and reduce your liability.

Vehicle-related expenses

- Fuel costs, including IFTA taxes

- Maintenance and repairs, including labor, parts, oil, tires, tools, and getting your truck washed

- Truck payments or leases

- Depreciation

- Business-related insurance premiums, including equipment insurance, commercial liability insurance, property damage insurance, business interruption insurance, and loss of cargo insurance

- Registration fees and taxes

- Vehicle registration fees

- Permits

- Licenses and taxes, including the Heavy Highway Vehicle Use Tax and the cost of maintaining your CDL

Travel-related expenses

- Lodging

- Sleeper berth furnishings, including appliances, bedding, and food storage

- 80% of meals purchased on the road (if you’re logging hours of service)

- Truck stop shower fees

Equipment and supplies

- Devices, including GPS, tablets, Smartphones, and laptops

- Logbook or journals

- Safety equipment, like safety goggles, steel-toed boots, a back brace, or other article designed to protect you while working

- Specialized work-related clothing, like footwear or protective headwear, company logo shirts or outerwear

Home office and communication costs

- Cell phone costs, in full if you use exclusively for work, a percentage if you use for personal & business;

- Internet, in full if used in your cab, a percentage if used at home for business & personal use

Health and medical expenses

- Regular DOT medical fitness exams to maintain your CDL and work-related health tests if you itemize them

Professional fees

- License renewals

- Association memberships

- Subscriptions to industry publications and websites

Schedule a demo.

Find out how our platform gives you the visibility you need to get more done.