Transportation Factoring

Whether you’re just starting out in the trucking business as an owner-operator or you’re struggling with cash flow challenges, transportation factoring can take the worry out of managing your finances.

Get paid in as little as one day from the day you submit an invoice. Transportation factoring can provide you with immediate cash and help you keep up on operating expenses, so you can keep your wheels turning.

- No more waiting 30 – 45+ days for a broker to process your invoices and pay you.

- Let your factoring company do your back-office invoicing, so you can get back on the road.

- Control when and which loads you wish to factor.

Choose a transportation factoring company that has your back.

There are many factoring companies out there. Choose one that works with you, offers flexible terms, and knows the freight transportation industry, truck factoring, and has experience with trucking companies. Factoring solutions are not all the same, and factoring companies vary widely in their requirements. Don’t sign on the dotted line until you’ve done your homework and read the fine print. Look for transportation factoring solutions that offer choice and flexibility. Here are some things to watch for:

- Does the factoring company require you to commit to a lengthy contract you’re not comfortable with?

- What is the financial penalty if you break a factoring contract?

- Are you required to factor all of your loads?

- How much does it cost?

- Do they offer non-recourse factoring? Non-recourse factoring protects you against risk in the event the broker doesn’t pay the invoice. With non-recourse factoring, you still get paid by the factoring company. This type of invoice factoring ensures you get paid for the work you do and is the best type of factoring for owner-operators and carriers in the freight transportation industry.

You work hard. You have plenty to worry about without worrying about cash flow.

Bills, living expenses, and operating expenses keep coming whether or not you’ve been paid. Not only that, but when you decided to become a freight carrier, you probably didn’t sign up to be a bookkeeper, accountant, or an accounts receivable agent. Yet you find yourself trying to tackle these back-office tasks to keep the money coming in. A good transportation factoring solution can take these time-consuming chores off your plate by handling your invoicing process.

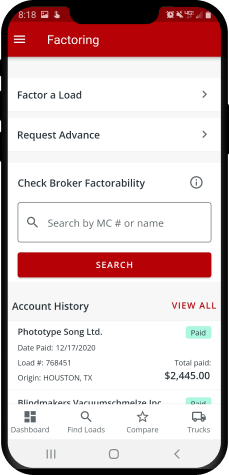

Also, make sure the truck factoring you choose has a mobile app, so you can keep up with your invoices and finances no matter where you are. With an invoice factoring app, you can:

- Factor loads on the go.

- Easily apply for advances.

- Get instant broker credit checks.

- View your unpaid and paid load history.

- Scan your paperwork any time, from any place.

Not only do freight owner-operators trust Truckstop to find good loads, they trust us to get paid.

If there’s one thing predictable about the freight industry, it’s that it’s unpredictable. Market conditions ebb and flow, which can impact cash flow. Even in uncertain times, getting paid should be a certainty. That’s where freight bill factoring comes in to take the burden off. At Truckstop we make the process simple, so you can get to the task at hand: finding loads and making money.

Here’s how it works: You’ve booked a load and successfully moved your freight. Instead of invoicing the broker (when you find the time to get to it) and waiting weeks to get paid, you submit your paperwork to Truckstop Factoring. You can even do this from the road with our mobile app. Once the freight bill factoring team verifies the invoice, you get payment right away (often within 24 hours if all goes smoothly).

get startedUnburden yourself from back-office backlog.

Maybe your trucking operation is going gangbusters, keeping your truck or fleet on the road, and keeping you busier than ever. Maybe for the first time, you can’t keep up with back-office billing and invoicing. This is another reason to take a look at transportation factoring services. Truckstop Factoring takes the paperwork and invoicing tasks off your hands and shifts it to our full-service billing team, saving you hours of valuable time and eliminating invoicing headaches.

Sign Me UpDon’t let cash-flow concerns drive your business to a screeching halt.

The name of the game is to keep your wheels turning and the cash flowing in. But in lean times or when facing late payments, not only do you need money to carry on, you need to keep your business moving forward. You need that next load and loads lined up after that. Lack of cash with no access to capital can stall out your efforts in the most fundamental way if you can’t afford the fuel or expenses to accept another load and keep going.

Business loans are one solution, but any extra debt you carry is a business liability. Plus, have you ever tried to play financial catch-up? You know it’s not fun and extremely stressful. Not to mention the hefty interest rates that can come with a traditional ban, loan. Like with any business, the less debt you take on, the better.

That’s why transportation factoring makes sense for the freight industry. It helps keep you moving forward, in good times and in bad. And it means you can focus on the core of your business and growing it.

Start FactoringFAQs

In the business world, factoring is a financial service in which the business owner sells open accounts receivables to a third-party (the factoring company) in order to raise funds. For a fee, the factoring company collects on the invoices and pays the business owner.

Practically speaking, in freight, you as an owner-operator sell your invoices to a factoring company who pays you right away and then collects the funds from the broker, minus a fee or percentage of the invoices.

It depends on the factoring company. While some transportation factoring companies require you to factor all your loads, not all factoring agencies have the same terms and requirements. With Truckstop Factoring, you’re the decision-maker. You decide which loads to factor. Factor one load, factor a few, factor all of them. It’s up to you.

Factoring has come a long way since the early days. There was a time when some companies were spotlighted for charging exorbitant fees and engaging in less-than-scrupulous business practices. Factoring had to evolve and weed out the bad eggs to change its bad reputation. Today, it’s a widely accepted practice and a trusted financial solution across many industries.