Taking the Dread Out of IFTA Reporting

Find your next load

Make more money starting now.

It’s no secret that the International Fuel Tax Agreement, otherwise known as IFTA, can be a huge pain. Countless hours spent viewing and reviewing your numbers, late nights with cold coffee, trying to make sense of figures and legalities.

No one likes calculating IFTA.

And when it comes to completing tasks we don’t like, most of us tend to procrastinate. So, in the blink of an eye, it’s the end of the quarter and you haven’t even started. It can be enough for some people to say, “Forget it.” After all, who likes doing taxes?

But letting yourself get behind on such an important task can really hurt your business and your bottom line. You can be left scrambling to get it completed, you lose time you could have invested in finding loads, and could be left wondering, “Did I do this right?” Or worse, “What if I get audited?” Procrastinating on IFTA can be very stressful and lead to a mess of other problems.

So, how do you stay organized and ensure you’re ready for such a tedious job? You could write everything down, keep it in a file, and spend a few hours doing the math every few months. You could take it all in to a tax service and pay someone to crunch the numbers for you. But what if you could do it yourself without stress and hours of lost time? What if calculating IFTA only took a few minutes of your time putting you back out there on the road or having dinner with the family?

Believe it or not, it can be that easy.

Using a software to complete your IFTA can save you a whole lot of time, money, and stress. There are plenty of IFTA programs out there, but how do you know which one is best? What should you look for?

The simple answer is automation.

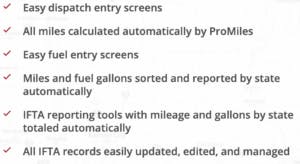

Look for a software program that will complete 99% of the work for you; in other words, look for a program that requires minimal data entry. The right software won’t ask you to enter your data prior to the end of the quarter, but rather it will track your mileage automatically with every load entry, from the very start.

With the right software, you don’t have to wait until the end of the quarter to enter your data – you can start right when you create a load. Easy-to-use programs will track your mileage right from the start. All you need to do is enter your fuel receipts, and if you’re aware of your expenses like most savvy owner-operators are, you will already know what you’re spending on fuel and in which state. Once this is completed, it’s as simple as hitting a button. In a snap, all that time-consuming math is calculated for you.

If you’re ready to automate your IFTA reporting, contact us today. Truckstop.com can help.

Find out how our platform gives you the visibility you need to get more done.

Get helpful content delivered to your inbox.

Schedule a demo.

Find out how our platform gives you the visibility you need to get more done.